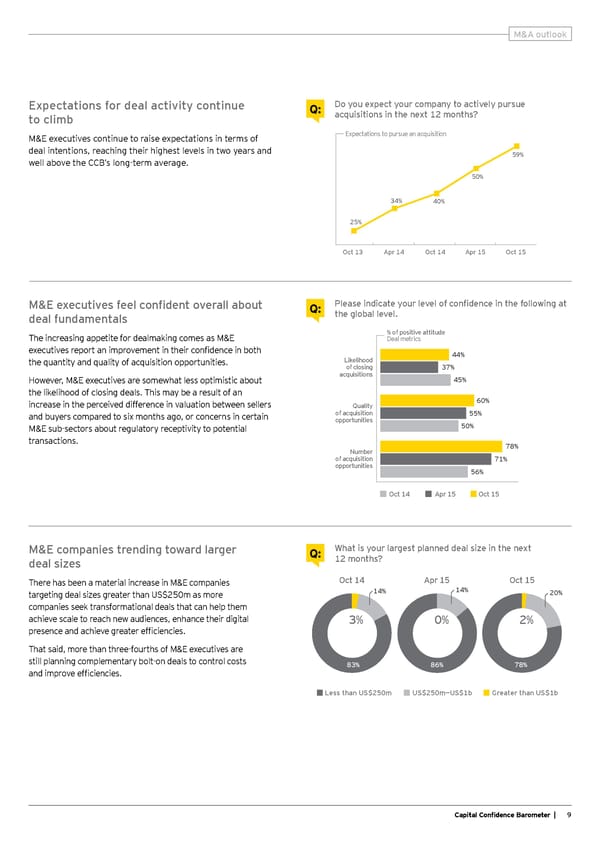

MM&&AA o ouuttllooookk Expectations for deal activity continue Q: Do you expect your company to actively pursue to climb acquisitions in the next 12 months? M&E executives continue to raise expectations in terms of Expectations to pursue an acquisition deal intentions, reaching their highest levels in two years and 59% well above the CCB’s long-term average. 50% 34% 40% 25% Oct 13 Apr 14 Oct 14 Apr 15 Oct 15 M&E executives feel confi dent overall about Q: Please indicate your level of confi dence in the following at deal fundamentals the global level. % of positive attitude The increasing appetite for dealmaking comes as M&E Deal metrics executives report an improvement in their confi dence in both 44% the quantity and quality of acquisition opportunities. Likelihood of closing 37% However, M&E executives are somewhat less optimistic about acquisitions 45% the likelihood of closing deals. This may be a result of an increase in the perceived difference in valuation between sellers Quality 60% and buyers compared to six months ago, or concerns in certain of acquisition 55% opportunities 50% M&E sub-sectors about regulatory receptivity to potential transactions. 78% Number of acquisition 71% opportunities 56% Oct 14 Apr 15 Oct 15 M&E companies trending toward larger Q: What is your largest planned deal size in the next deal sizes 12 months? There has been a material increase in M&E companies Oct 14 Apr 15 Oct 15 targeting deal sizes greater than US$250m as more 14% 14% 20% companies seek transformational deals that can help them achieve scale to reach new audiences, enhance their digital 3% 0% 2% presence and achieve greater effi ciencies. That said, more than three-fourths of M&E executives are still planning complementary bolt-on deals to control costs 83% 86% 78% and improve effi ciencies. Less than US$250m US$250m—US$1b Greater than US$1b Capital Confi dence Barometer | 9

Capital Confidence Barometer Page 10 Page 12

Capital Confidence Barometer Page 10 Page 12