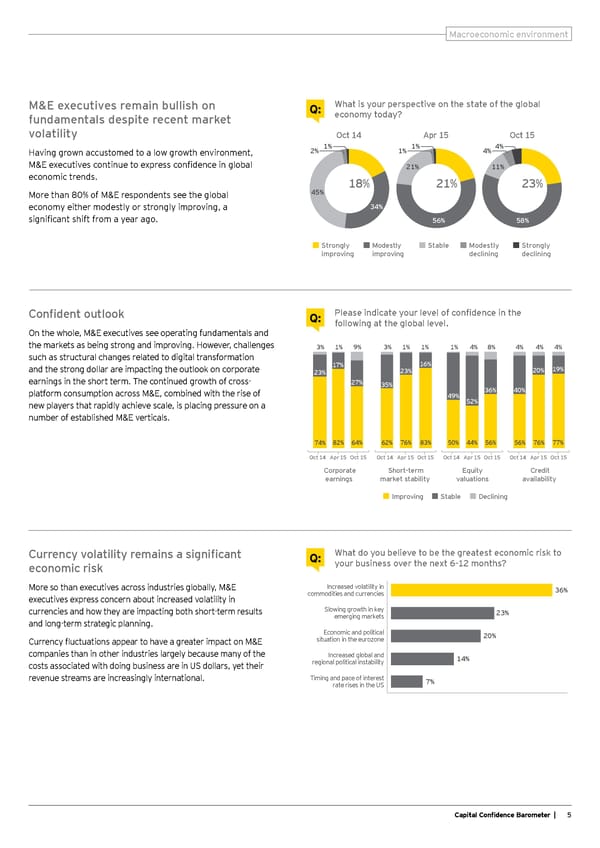

Macroeconomic environment M&E executives remain bullish on Q: What is your perspective on the state of the global fundamentals despite recent market economy today? volatility Oct 14 Apr 15 Oct 15 Having grown accustomed to a low growth environment, 2% 1% 1% 1% 4% 4% M&E executives continue to express confi dence in global 21% 11% economic trends. 18% 21% 23% More than 80% of M&E respondents see the global 45% economy either modestly or strongly improving, a 34% signifi cant shift from a year ago. 56% 58% Strongly Modestly Stable Modestly Strongly improving improving declining declining Confi dent outlook Q: Please indicate your level of confi dence in the following at the global level. On the whole, M&E executives see operating fundamentals and the markets as being strong and improving. However, challenges 3% 1% 9% 3% 1% 1% 1% 4% 8% 4% 4% 4% such as structural changes related to digital transformation 16% and the strong dollar are impacting the outlook on corporate 17% 23% 20% 19% 23% earnings in the short term. The continued growth of cross- 27% 35% platform consumption across M&E, combined with the rise of 49% 36% 40% new players that rapidly achieve scale, is placing pressure on a 52% number of established M&E verticals. 74% 82% 64% 62% 76% 83% 50% 44% 56% 56% 76% 77% Oct 14 Apr 15 Oct 15 Oct 14 Apr 15 Oct 15 Oct 14 Apr 15 Oct 15 Oct 14 Apr 15 Oct 15 Corporate Short-term Equity Credit earnings market stability valuations availability Improving Stable Declining Currency volatility remains a signifi cant Q: What do you believe to be the greatest economic risk to economic risk your business over the next 6-12 months? More so than executives across industries globally, M&E Increased volatility in 36% executives express concern about increased volatility in commodities and currencies currencies and how they are impacting both short-term results Slowing growth in key 23% and long-term strategic planning. emerging markets Economic and political 20% Currency fl uctuations appear to have a greater impact on M&E situation in the eurozone companies than in other industries largely because many of the Increased global and 14% costs associated with doing business are in US dollars, yet their regional political instability revenue streams are increasingly international. Timing and pace of interest 7% rate rises in the US Capital Confi dence Barometer | 5

Capital Confidence Barometer Page 6 Page 8

Capital Confidence Barometer Page 6 Page 8