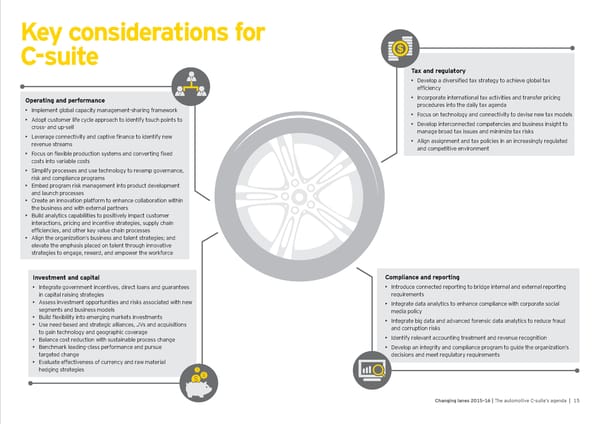

Key considerations for C-suite Tax and regulatory • Develop a diversified tax strategy to achieve global tax efficiency Operating and performance • Incorporate international tax activities and transfer pricing • Implement global capacity management-sharing framework procedures into the daily tax agenda • Adopt customer life cycle approach to identify touch points to • Focus on technology and connectivity to devise new tax models cross- and up-sell • Develop interconnected competencies and business insight to • Leverage connectivity and captive finance to identify new manage broad tax issues and minimize tax risks revenue streams • Align assignment and tax policies in an increasingly regulated • Focus on flexible production systems and converting fixed and competitive environment costs into variable costs • Simplify processes and use technology to revamp governance, risk and compliance programs • Embed program risk management into product development and launch processes • Create an innovation platform to enhance collaboration within the business and with external partners • Build analytics capabilities to positively impact customer interactions, pricing and incentive strategies, supply chain efficiencies, and other key value chain processes • Align the organization’s business and talent strategies; and elevate the emphasis placed on talent through innovative strategies to engage, reward, and empower the workforce Investment and capital Compliance and reporting • Integrate government incentives, direct loans and guarantees • Introduce connected reporting to bridge internal and external reporting in capital raising strategies requirements • Assess investment opportunities and risks associated with new • Integrate data analytics to enhance compliance with corporate social segments and business models media policy • Build flexibility into emerging markets investments • Integrate big data and advanced forensic data analytics to reduce fraud • Use need-based and strategic alliances, JVs and acquisitions and corruption risks to gain technology and geographic coverage • Balance cost reduction with sustainable process change • Identify relevant accounting treatment and revenue recognition • Benchmark leading-class performance and pursue • Develop an integrity and compliance program to guide the organization’s targeted change decisions and meet regulatory requirements • Evaluate effectiveness of currency and raw material hedging strategies Changing lanes 2015-16 | The automotive C-suite’s agenda | 15

Changing Lanes Page 14 Page 16

Changing Lanes Page 14 Page 16