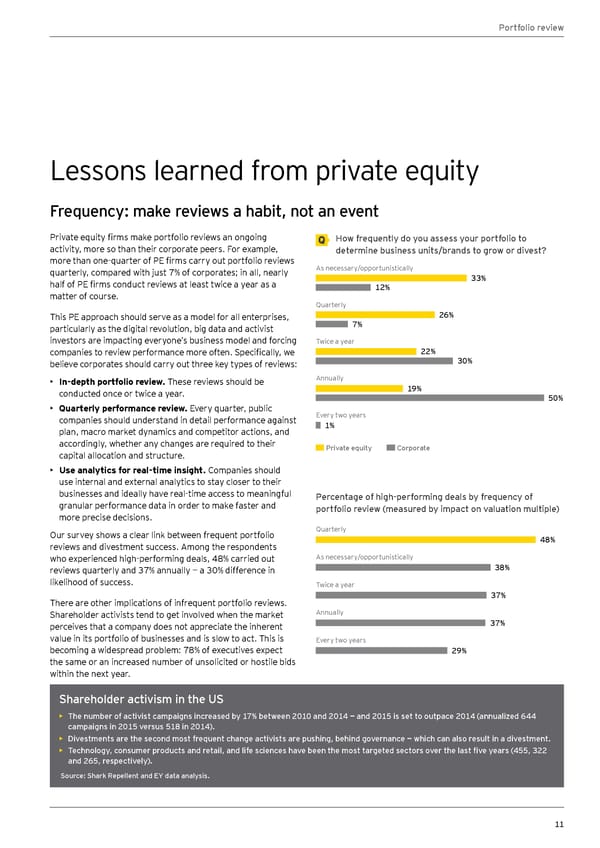

Portfolio review Lessons learned from private equity Frequency: make reviews a habit, not an event Private equity firms make portfolio reviews an ongoing How frequently do you assess your portfolio to activity, more so than their corporate peers. For example, determine business units/brands to grow or divest? more than one-quarter of PE firms carry out portfolio reviews As necessary/opportunistically quarterly, compared with just 7% of corporates; in all, nearly 33% half of PE firms conduct reviews at least twice a year as a 12% matter of course. Quarterly This PE approach should serve as a model for all enterprises, 26% particularly as the digital revolution, big data and activist 7% investors are impacting everyone’s business model and forcing Twice a year companies to review performance more often. Specifically, we 22% believe corporates should carry out three key types of reviews: 30% • In-depth portfolio review. These reviews should be Annually conducted once or twice a year. 19% 50% • Quarterly performance review. Every quarter, public Every two years companies should understand in detail performance against 1% plan, macro market dynamics and competitor actions, and accordingly, whether any changes are required to their Private equity Corporate capital allocation and structure. • Use analytics for real-time insight. Companies should use internal and external analytics to stay closer to their businesses and ideally have real-time access to meaningful Percentage of high-performing deals by frequency of granular performance data in order to make faster and portfolio review (measured by impact on valuation multiple) more precise decisions. Our survey shows a clear link between frequent portfolio Quarterly reviews and divestment success. Among the respondents 48% who experienced high-performing deals, 48% carried out As necessary/opportunistically reviews quarterly and 37% annually — a 30% difference in 38% likelihood of success. Twice a year There are other implications of infrequent portfolio reviews. 37% Shareholder activists tend to get involved when the market Annually perceives that a company does not appreciate the inherent 37% value in its portfolio of businesses and is slow to act. This is Every two years becoming a widespread problem: 78% of executives expect 29% the same or an increased number of unsolicited or hostile bids within the next year. Shareholder activism in the US • The number of activist campaigns increased by 17% between 2010 and 2014 — and 2015 is set to outpace 2014 (annualized 644 campaigns in 2015 versus 518 in 2014). • Divestments are the second most frequent change activists are pushing, behind governance — which can also result in a divestment. • Technology, consumer products and retail, and life sciences have been the most targeted sectors over the last five years (455, 322 and 265, respectively). Source: Shark Repellent and EY data analysis. 11

Global Corporate Divestment Study Page 10 Page 12

Global Corporate Divestment Study Page 10 Page 12