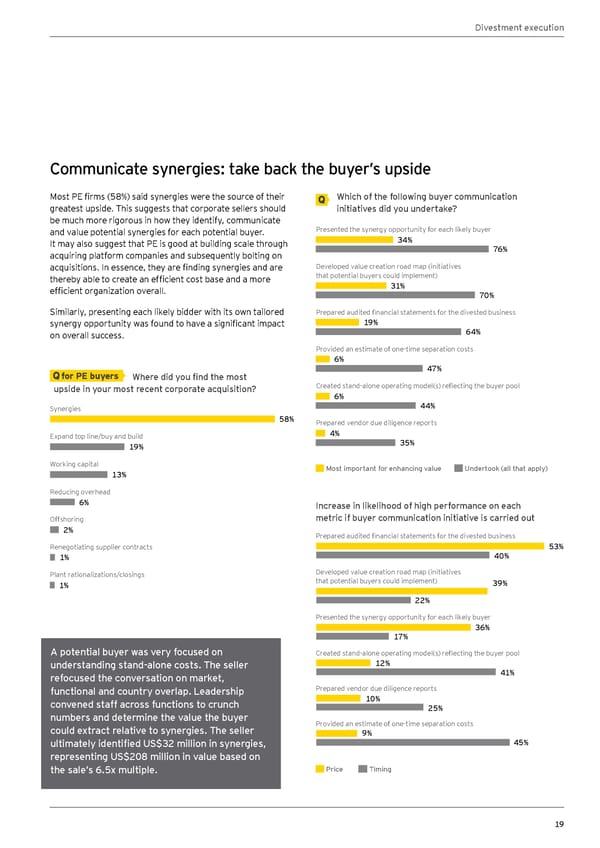

Divestment execution Communicate synergies: take back the buyer’s upside Most PE firms (58%) said synergies were the source of their Which of the following buyer communication greatest upside. This suggests that corporate sellers should initiatives did you undertake? be much more rigorous in how they identify, communicate and value potential synergies for each potential buyer. Presented the synergy opportunity for each likely buyer It may also suggest that PE is good at building scale through 34% acquiring platform companies and subsequently bolting on 76% acquisitions. In essence, they are finding synergies and are Developed value creation road map (initiatives thereby able to create an efficient cost base and a more that potential buyers could implement) efficient organization overall. 31% 70% Similarly, presenting each likely bidder with its own tailored Prepared audited financial statements for the divested business synergy opportunity was found to have a significant impact 19% on overall success. 64% Provided an estimate of one-time separation costs 6% for PE buyers Where did you find the most 47% upside in your most recent corporate acquisition? Created stand-alone operating model(s) reflecting the buyer pool 6% Synergies 44% 58% Prepared vendor due diligence reports Expand top line/buy and build 4% 19% 35% Working capital Most important for enhancing value Undertook (all that apply) 13% Reducing overhead 6% Increase in likelihood of high performance on each Offshoring metric if buyer communication initiative is carried out 2% Prepared audited financial statements for the divested business Renegotiating supplier contracts 53% 1% 40% Plant rationalizations/closings Developed value creation road map (initiatives 1% that potential buyers could implement) 39% 22% Presented the synergy opportunity for each likely buyer 36% 17% A potential buyer was very focused on Created stand-alone operating model(s) reflecting the buyer pool understanding stand-alone costs. The seller 12% refocused the conversation on market, 41% functional and country overlap. Leadership Prepared vendor due diligence reports convened staff across functions to crunch 10% numbers and determine the value the buyer 25% could extract relative to synergies. The seller Provided an estimate of one-time separation costs 9% ultimately identified US$32 million in synergies, 45% representing US$208 million in value based on the sale’s 6.5x multiple. Price Timing 19

Global Corporate Divestment Study Page 18 Page 20

Global Corporate Divestment Study Page 18 Page 20