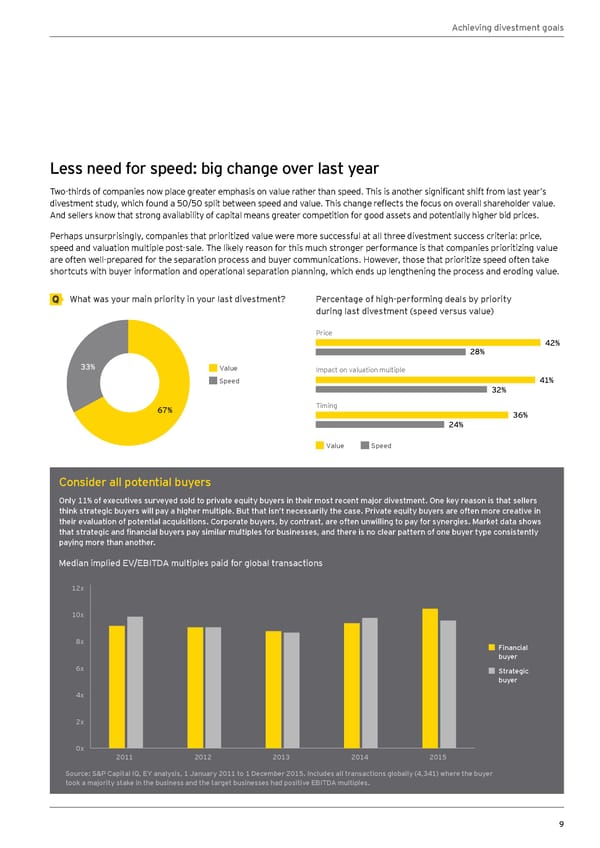

Achieving divestment goals Less need for speed: big change over last year Two-thirds of companies now place greater emphasis on value rather than speed. This is another significant shift from last year’s divestment study, which found a 50/50 split between speed and value. This change reflects the focus on overall shareholder value. And sellers know that strong availability of capital means greater competition for good assets and potentially higher bid prices. Perhaps unsurprisingly, companies that prioritized value were more successful at all three divestment success criteria: price, speed and valuation multiple post-sale. The likely reason for this much stronger performance is that companies prioritizing value are often well-prepared for the separation process and buyer communications. However, those that prioritize speed often take shortcuts with buyer information and operational separation planning, which ends up lengthening the process and eroding value. What was your main priority in your last divestment? Percentage of high-performing deals by priority during last divestment (speed versus value) Price 42% 28% 33% Value Impact on valuation multiple Speed 41% 32% 67% Timing 36% 24% Value Speed Consider all potential buyers Only 11% of executives surveyed sold to private equity buyers in their most recent major divestment. One key reason is that sellers think strategic buyers will pay a higher multiple. But that isn’t necessarily the case. Private equity buyers are often more creative in their evaluation of potential acquisitions. Corporate buyers, by contrast, are often unwilling to pay for synergies. Market data shows that strategic and financial buyers pay similar multiples for businesses, and there is no clear pattern of one buyer type consistently paying more than another. Median implied EV/EBITDA multiples paid for global transactions 12x 10x 8x Financial buyer 6x Strategic buyer 4x Exceeded expectations Met expectations 2x Did not meet expectations 0x 2011 2012 2013 2014 2015 Source: S&P Capital IQ, EY analysis, 1 January 2011 to 1 December 2015. Includes all transactions globally (4,341) where the buyer took a majority stake in the business and the target businesses had positive EBITDA multiples. 9

Global Corporate Divestment Study Page 8 Page 10

Global Corporate Divestment Study Page 8 Page 10