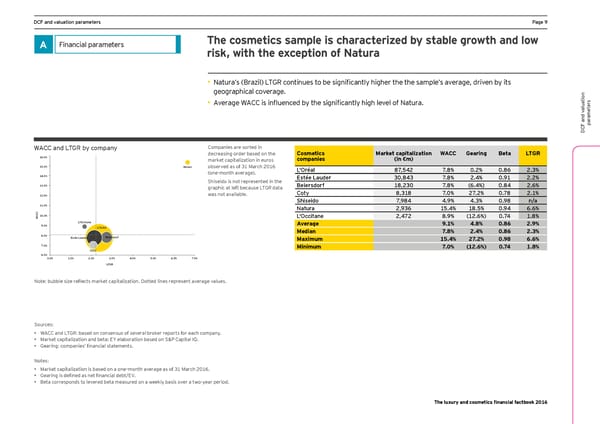

DCF and valuation parameters Ha_e 1 A Financial parameters The cosmetics sample is characterized by stable growth and low risk, with the exception of Natura • Fatmra’s :raril! DL?J continmes to be significantlq higher the the sample’s anerage, drinen bq its geographical coverage. • 9nerage O9;; is inÖmenced bq the significantlq high lenel of Fatmra. s er aluationt ame ar p DCF and v O9;; and DL?J Zy cgepany Companies are sorted in decreasing order based on the Cosmetics Market capitalization WACC Gearing Beta LTGR 16.0% market capitalization in euros companies (in €m) 15.0% Natura observed as of 31 March 2016 L'Oréal 0/$-,* /&0 (&* (&0. *&+ (one-month average). 14.0% Estée Lauder +($0,+ /&0 *&, (&1) *&* Shiseido is not represented in the 13.0% graphic at left because LTGR data :eiejsdgj^ )0$*+( /&0 .&, ! (&0, *&. 12.0% was not available. Coty 0$+)0 /&( */&* (&/0 *&) Shiseido /$10, ,&1 ,&+ (&10 n/a 11.0% Natura *$1+. )-&, )0&- (&1, .&. C C10.0% L'Occitane 2,472 0&1 )*&. ! (&/, )&0 WA L'Occitane Average 9.1% 4.8% 0.86 2.9% 9.0% L'Oréal LVMH Median 7.8% 2.4% 0.86 2.3% 8.0% Estée Lauder Beiersdorf Maximum 15.4% 27.2% 0.98 6.6% 7.0% Minimum 7.0% (12.6%) 0.74 1.8% Coty 6.0% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% LTGR Fote2 bmbble sire reÖects marcet capitaliration.

Luxury and Cosmetic Financial Factbook Page 10 Page 12

Luxury and Cosmetic Financial Factbook Page 10 Page 12