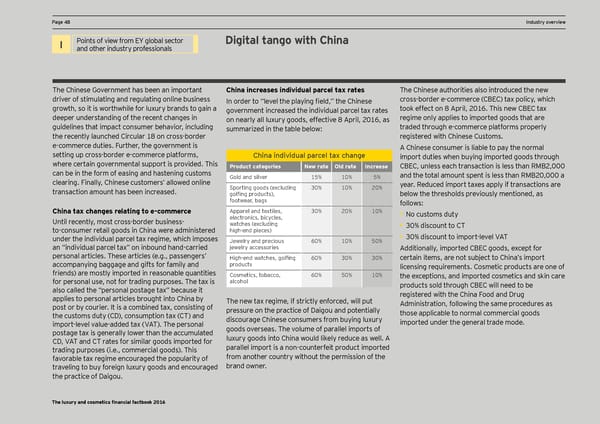

HHa_e ,0a_e ,0 DCF and valuation pIndustry oaramevervieterws I Points of view from EY global sector Digital tango with China and other industry professionals The Chinese Government has been an important China increases individual parcel tax rates The Chinese authorities also introduced the new driver of stimulating and regulating online business In order to ËËlenel the plaqing field,’’ the ;hinese cross-border e-commerce (CBEC) tax policy, which growth, so it is worthwhile for luxury brands to gain a government increased the individual parcel tax rates took effect on 8 April, 2016. This new CBEC tax deeper understanding of the recent changes in on nearly all luxury goods, effective 8 April, 2016, as regime only applies to imported goods that are guidelines that impact consumer behavior, including summarized in the table below: traded through e-commerce platforms properly the recently launched Circular 18 on cross-border registered with Chinese Customs. e-commerce duties. Further, the government is A Chinese consumer is liable to pay the normal setting up cross-border e-commerce platforms, China individual parcel tax change import duties when buying imported goods through where certain governmental support is provided. This Product categories New rate Old rate Increase CBEC, unless each transaction is less than RMB2,000 can be in the form of easing and hastening customs Gold and silver 15% 10% 5% and the total amount spent is less than RMB20,000 a clearing. Finally, Chinese customers’ allowed online Sporting goods (excluding 30% 10% 20% year. Reduced import taxes apply if transactions are transaction amount has been increased. golfing prodmcts!, below the thresholds previously mentioned, as footwear, bags follows: China tax changes relating to e-commerce Apparel and textiles, 30% 20% 10% • No customs duty Until recently, most cross-border business- electronics, bicycles, watches (excluding • 30% discount to CT to-consumer retail goods in China were administered high-end pieces) • 30% discomnt to import%lenel N9L under the individual parcel tax regime, which imposes Jewelry and precious 60% 10% 50% an “individual parcel tax” on inbound hand-carried jewelry accessories Additionally, imported CBEC goods, except for personal articles. These articles (e.g., passengers’ @igh%end oatches, golfing 60% 30% 30% certain items, are not subject to China’s import accompanying baggage and gifts for family and products licensing reimirements. ;osmetic prodmcts are one of friends! are mostlq imported in reasonable imantities Cosmetics, tobacco, 60% 50% 10% the exceptions, and imported cosmetics and skin care for personal use, not for trading purposes. The tax is alcohol products sold through CBEC will need to be also called the “personal postage tax” because it registered with the China Food and Drug applies to personal articles brought into China by The new tax regime, if strictly enforced, will put Administration, following the same procedures as post or by courier. It is a combined tax, consisting of pressure on the practice of Daigou and potentially those applicable to normal commercial goods the customs duty (CD), consumption tax (CT) and discourage Chinese consumers from buying luxury imported under the general trade mode. import%lenel nalme%added tax N9L!. Lhe personal goods overseas. The volume of parallel imports of postage tax is generally lower than the accumulated luxury goods into China would likely reduce as well. A ;<, N9L and ;L rates for similar goods imported for parallel import is a non-counterfeit product imported trading purposes (i.e., commercial goods). This from another country without the permission of the favorable tax regime encouraged the popularity of traveling to buy foreign luxury goods and encouraged brand owner. the practice of Daigou. The luxury and cosmetics financial factbook 2016

Luxury and Cosmetic Financial Factbook Page 49 Page 51

Luxury and Cosmetic Financial Factbook Page 49 Page 51