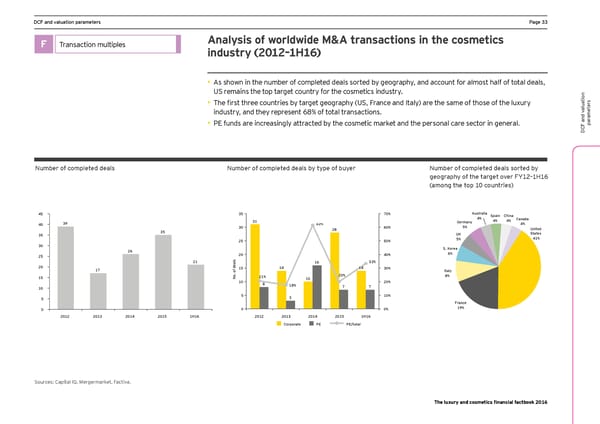

DCF and valuation parameters Page 33 F Transaction multiples Analysis of worldwide M&A transactions in the cosmetics industry (2012–1H16) • As shown in the number of completed deals sorted by geography, and account for almost half of total deals, US remains the top target country for the cosmetics industry. • Lhe first three comntries bq target geography (US, France and Italy) are the same of those of the luxury s er industry, and they represent 68% of total transactions. aluationt ame ar • PE funds are increasingly attracted by the cosmetic market and the personal care sector in general. p DCF and v FmeZej g^ cgepleled deals FmeZej g^ cgepleled deals Zy lype g^ Zmyej FmeZej g^ cgepleled deals sgjled Zy _eg_jap`y g^ l`e laj_el gnej >Q)*Ç)@). aegn_ l`e lgp )( cgmnljies! 45 35 70% Australia Spain China 31 4% 4% 4% Canada 40 39 62% Germany 4% 30 28 60% 5% United 35 35 UK States 25 50% 5% 41% 30 S. Korea 26 6% 25 20 40% s 21 l 16 33% a e 20 d 14 14 15 30% 17 f Italy o . 20% 15 o 21% 8% N 10 10 8 18% 20% 10 7 7 5 5 3 10% France 0 0 0% 19% 2012 2013 2014 2015 1H16 2012 2013 2014 2015 1H16 Corporate PE PE/total Sources: Capital IQ, Mergermarket, Factiva. The luxury and cosmetics financial factbook 2016

Luxury and Cosmetic Financial Factbook Page 34 Page 36

Luxury and Cosmetic Financial Factbook Page 34 Page 36