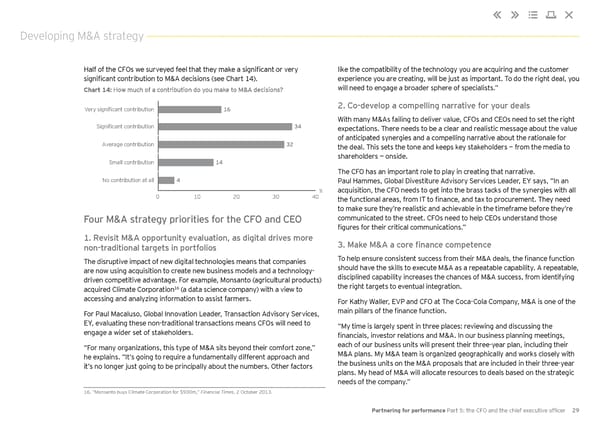

Developing M&A strategy Half of the CFOs we surveyed feel that they make a significant or very like the compatibility of the technology you are acquiring and the customer significant contribution to M&A decisions (see Chart 14). experience you are creating, will be just as important. To do the right deal, you Chart 14: How much of a contribution do you make to M&A decisions? will need to engage a broader sphere of specialists.” Very significant contribution 16 2. Co-develop a compelling narrative for your deals With many M&As failing to deliver value, CFOs and CEOs need to set the right Significant contribution 34 expectations. There needs to be a clear and realistic message about the value of anticipated synergies and a compelling narrative about the rationale for Average contribution 32 the deal. This sets the tone and keeps key stakeholders — from the media to shareholders — onside. Small contribution 14 The CFO has an important role to play in creating that narrative. No contribution at all 4 Paul Hammes, Global Divestiture Advisory Services Leader, EY says, “In an % acquisition, the CFO needs to get into the brass tacks of the synergies with all 0 10 20 30 40 the functional areas, from IT to finance, and tax to procurement. They need to make sure they’re realistic and achievable in the timeframe before they’re Four M&A strategy priorities for the CFO and CEO communicated to the street. CFOs need to help CEOs understand those figures for their critical communications.” 1. Revisit M&A opportunity evaluation, as digital drives more 3. Make M&A a core finance competence non-traditional targets in portfolios The disruptive impact of new digital technologies means that companies To help ensure consistent success from their M&A deals, the finance function are now using acquisition to create new business models and a technology- should have the skills to execute M&A as a repeatable capability. A repeatable, driven competitive advantage. For example, Monsanto (agricultural products) disciplined capability increases the chances of M&A success, from identifying 16 the right targets to eventual integration. acquired Climate Corporation (a data science company) with a view to accessing and analyzing information to assist farmers. For Kathy Waller, EVP and CFO at The Coca-Cola Company, M&A is one of the For Paul Macaluso, Global Innovation Leader, Transaction Advisory Services, main pillars of the finance function. EY, evaluating these non-traditional transactions means CFOs will need to “My time is largely spent in three places: reviewing and discussing the engage a wider set of stakeholders. financials, investor relations and M&A. In our business planning meetings, “For many organizations, this type of M&A sits beyond their comfort zone,” each of our business units will present their three-year plan, including their he explains. “It’s going to require a fundamentally different approach and M&A plans. My M&A team is organized geographically and works closely with it’s no longer just going to be principally about the numbers. Other factors the business units on the M&A proposals that are included in their three-year plans. My head of M&A will allocate resources to deals based on the strategic needs of the company.” 16. “Monsanto buys Climate Corporation for $930m,” Financial Times, 2 October 2013. Partnering for performance Part 5: the CFO and the chief executive officer 29

Partnering for Performance Part 5 Page 30 Page 32

Partnering for Performance Part 5 Page 30 Page 32