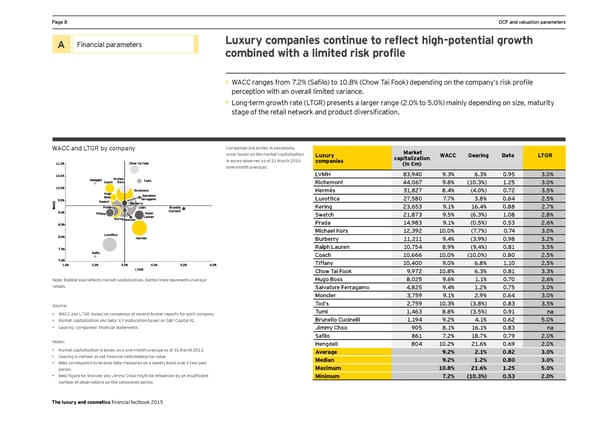

Page 8 DCF and valuation parameters A Financial parameters Luxury companies continue to reflect high-potential growth combined with a limited risk profile • WACC ranges from 7.2% (Safilo) to 10.8% (Chow Tai Fook) depending on the company’s risk profile perception with an overall limited variance. • Long-term growth rate (LTGR) presents a larger range (2.0% to 5.0%) mainly depending on size, maturity stage of the retail network and product diversification. WACC and LTGR by company Companies are sorted in decreasing Market order based on the market capitalization Luxury capitalization WACC Gearing Beta LTGR in euros observed as of 31 March 2015 companies (in €m) (one-month average). LVMH 83,940 9.3% 6.3% 0.95 3.0% Richemont 44,067 9.8% (10.3%) 1.25 3.0% Hermès 31,827 8.4% (4.0%) 0.72 3.5% Luxottica 27,580 7.7% 3.8% 0.64 2.5% Kering 23,653 9.1% 16.4% 0.88 2.7% Swatch 21,873 9.5% (6.3%) 1.08 2.8% Prada 14,983 9.1% (0.5%) 0.53 2.6% Michael Kors 12,392 10.0% (7.7%) 0.74 3.0% Burberry 11,211 9.4% (3.9%) 0.98 3.2% Ralph Lauren 10,754 8.9% (9.4%) 0.81 3.5% Coach 10,666 10.0% (10.0%) 0.80 2.5% Tiffany 10,400 9.0% 6.8% 1.10 2.5% Chow Tai Fook 9,972 10.8% 6.3% 0.81 3.3% Note: Bubble size reflects market capitalization. Dotted lines represents average Hugo Boss 8,025 9.6% 1.1% 0.70 2.6% values. Salvatore Ferragamo 4,825 9.4% 1.2% 0.75 3.0% Moncler 3,759 9.1% 2.9% 0.64 3.0% Source: Tod’s 2,759 10.3% (3.8%) 0.83 3.5% • WACC and LTGR: based on consensus of several broker reports for each company Tumi 1,463 8.8% (3.5%) 0.91 na • Market capitalization and beta: EY elaboration based on S&P Capital IQ Brunello Cucinelli 1,194 9.2% 4.1% 0.62 5.0% • Gearing: companies’ financial statements Jimmy Choo 905 8.1% 16.1% 0.83 na Safilo 861 7.2% 18.7% 0.79 2.0% Notes: Hengdeli 804 10.2% 21.6% 0.69 2.0% • Market capitalization is based on a one-month average as of 31 March 2015. Average 9.2% 2.1% 0.82 3.0% • Gearing is defined as net financial debt/enterprise value. Median 9.2% 1.2% 0.80 3.0% • Beta corresponds to levered beta measured on a weekly basis over a two-year Maximum 10.8% 21.6% 1.25 5.0% period. • Beta figure for Moncler and Jimmy Choo might be influenced by an insufficient Minimum 7.2% (10.3%) 0.53 2.0% number of observations on the considered period. The luxury and cosmetics financial factbook 2015

Seeking sustainable growth - The luxury and cosmetics financial factbook Page 9 Page 11

Seeking sustainable growth - The luxury and cosmetics financial factbook Page 9 Page 11