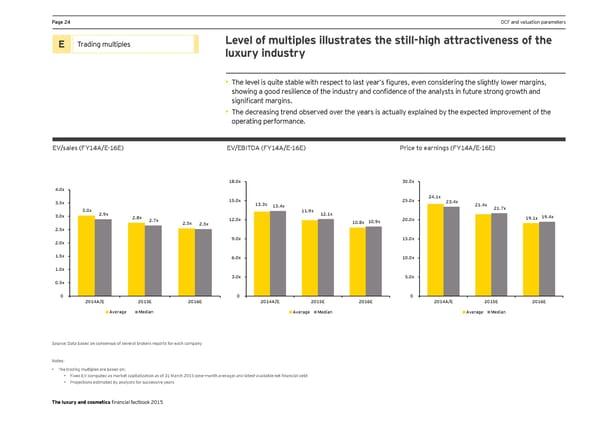

Page 24 DCF and valuation parameters E Trading multiples Level of multiples illustrates the still-high attractiveness of the luxury industry • The level is quite stable with respect to last year’s figures, even considering the slightly lower margins, showing a good resilience of the industry and confidence of the analysts in future strong growth and significant margins. • The decreasing trend observed over the years is actually explained by the expected improvement of the operating performance. EV/sales (FY14A/E-16E) EV/EBITDA (FY14A/E-16E) Price to earnings (FY14A/E-16E) 18.0x 30.0x 4.0x 15.0x 25.0x 24.1x 3.5x 13.3x 13.4x 23.4x 21.4x 3.0x 11.9x 21.7x 3.0x 2.9x 2.8x 12.1x 19.1x 19.4x 2.7x 2.5x 12.0x 10.8x 10.9x 20.0x 2.5x 2.5x 2.0x 9.0x 15.0x 1.5x 6.0x 10.0x 1.0x 3.0x 5.0x 0.5x 0 0 0 2014A/E 2015E 2016E 2014A/E 2015E 2016E 2014A/E 2015E 2016E Average Median Average Median Average Median Source: Data based on consensus of several brokers reports for each company Notes: • The trading multiples are based on: • Fixed EV computed as market capitalization as of 31 March 2015 (one-month average) and latest-available net financial debt • Projections estimated by analysts for successive years The luxury and cosmetics financial factbook 2015

Seeking sustainable growth - The luxury and cosmetics financial factbook Page 25 Page 27

Seeking sustainable growth - The luxury and cosmetics financial factbook Page 25 Page 27