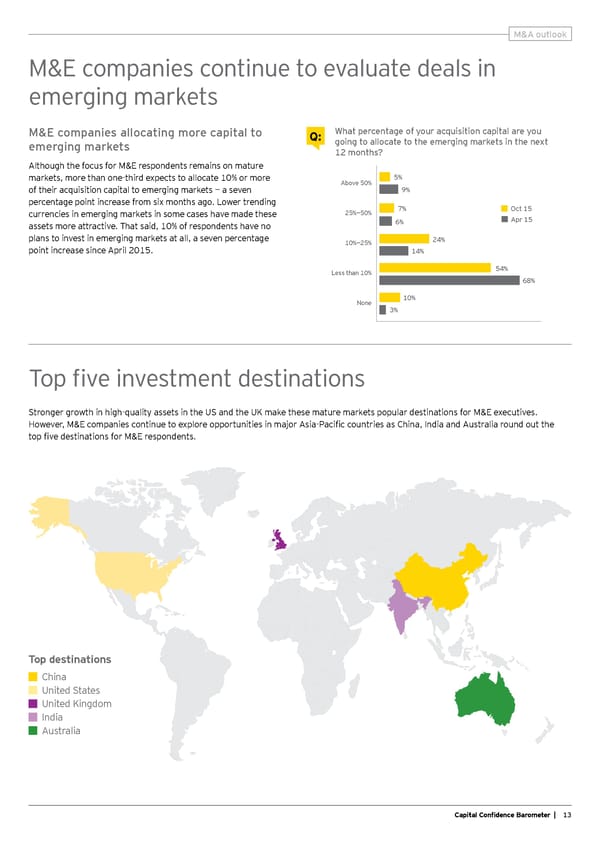

MM&&AA o ouuttllooookk M&E companies continue to evaluate deals in emerging markets M&E companies allocating more capital to Q: What percentage of your acquisition capital are you emerging markets going to allocate to the emerging markets in the next 12 months? Although the focus for M&E respondents remains on mature markets, more than one-third expects to allocate 10% or more Above 50% 5% of their acquisition capital to emerging markets — a seven 9% percentage point increase from six months ago. Lower trending 7% Oct 15 currencies in emerging markets in some cases have made these 25%—50% Apr 15 assets more attractive. That said, 10% of respondents have no 6% plans to invest in emerging markets at all, a seven percentage 10%—25% 24% point increase since April 2015. 14% Less than 10% 54% 68% None 10% 3% Top fi ve investment destinations Stronger growth in high-quality assets in the US and the UK make these mature markets popular destinations for M&E executives. However, M&E companies continue to explore opportunities in major Asia-Pacifi c countries as China, India and Australia round out the top fi ve destinations for M&E respondents. Top destinations China United States United Kingdom India Australia Capital Confi dence Barometer | 13

Capital Confidence Barometer Page 14 Page 16

Capital Confidence Barometer Page 14 Page 16