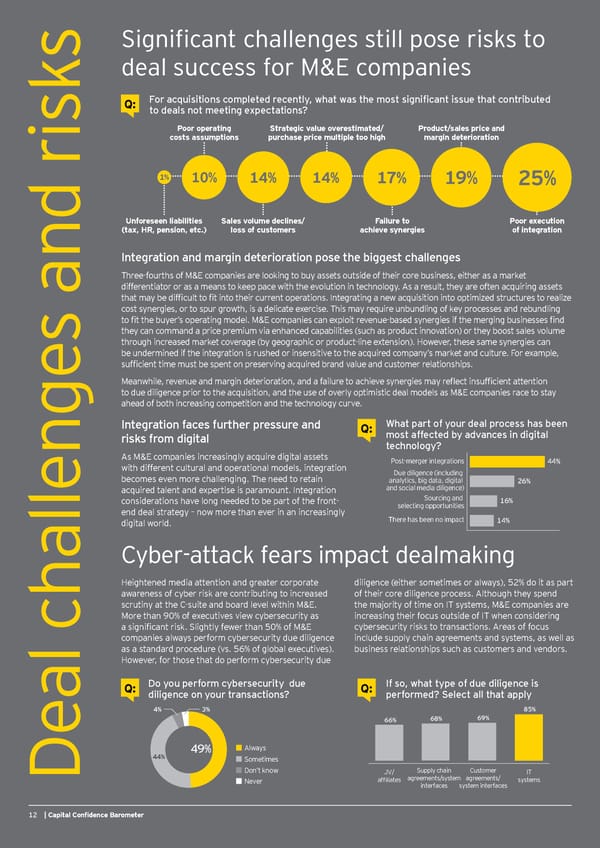

s Signifi cant challenges still pose risks to deal success for M&E companies Q: For acquisitions completed recently, what was the most signifi cant issue that contributed to deals not meeting expectations? Poor operating Strategic value overestimated/ Product/sales price and costs assumptions purchase price multiple too high margin deterioration 1% 10% 14% 14% 17% 19% 25% Unforeseen liabilities Sales volume declines/ Failure to Poor execution (tax, HR, pension, etc.) loss of customers achieve synergies of integration Integration and margin deterioration pose the biggest challenges Three-fourths of M&E companies are looking to buy assets outside of their core business, either as a market differentiator or as a means to keep pace with the evolution in technology. As a result, they are often acquiring assets that may be diffi cult to fi t into their current operations. Integrating a new acquisition into optimized structures to realize cost synergies, or to spur growth, is a delicate exercise. This may require unbundling of key processes and rebundling to fi t the buyer’s operating model. M&E companies can exploit revenue-based synergies if the merging businesses fi nd s and risk they can command a price premium via enhanced capabilities (such as product innovation) or they boost sales volume through increased market coverage (by geographic or product-line extension). However, these same synergies can be undermined if the integration is rushed or insensitive to the acquired company’s market and culture. For example, suffi cient time must be spent on preserving acquired brand value and customer relationships. Meanwhile, revenue and margin deterioration, and a failure to achieve synergies may refl ect insuffi cient attention to due diligence prior to the acquisition, and the use of overly optimistic deal models as M&E companies race to stay ahead of both increasing competition and the technology curve. Integration faces further pressure and Q: What part of your deal process has been risks from digital most affected by advances in digital technology? As M&E companies increasingly acquire digital assets Post-merger integrations 44% with different cultural and operational models, integration Due diligence (including becomes even more challenging. The need to retain analytics, big data, digital 26% acquired talent and expertise is paramount. Integration and social media diligence) considerations have long needed to be part of the front- Sourcing and 16% end deal strategy – now more than ever in an increasingly selecting opportunities digital world. There has been no impact 14% Cyber-attack fears impact dealmaking Heightened media attention and greater corporate diligence (either sometimes or always), 52% do it as part awareness of cyber risk are contributing to increased of their core diligence process. Although they spend scrutiny at the C-suite and board level within M&E. the majority of time on IT systems, M&E companies are More than 90% of executives view cybersecurity as increasing their focus outside of IT when considering a signifi cant risk. Slightly fewer than 50% of M&E cybersecurity risks to transactions. Areas of focus companies always perform cybersecurity due diligence include supply chain agreements and systems, as well as as a standard procedure (vs. 56% of global executives). business relationships such as customers and vendors. However, for those that do perform cybersecurity due Q: Do you perform cybersecurity due Q: If so, what type of due diligence is al challenge diligence on your transactions? performed? Select all that apply 4% 3% 85% 66% 68% 69% 49% Always 44% Sometimes Don’t know JV/ Supply chain Customer IT De Never Y^ÕdaYl]k agreements/system agreements/ systems interfaces system interfaces 12 | Capital Confi dence Barometer

Capital Confidence Barometer Page 13 Page 15

Capital Confidence Barometer Page 13 Page 15