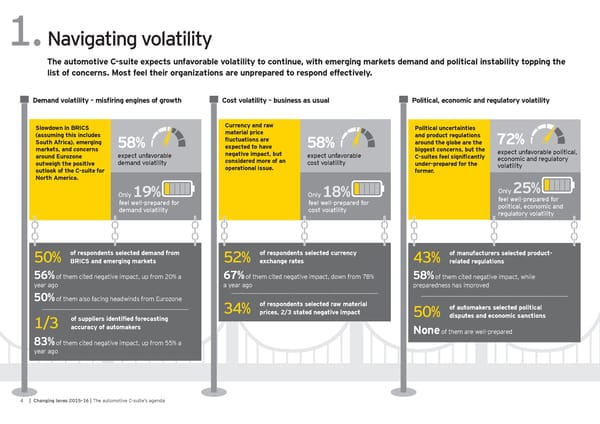

1.Navigating volatility The automotive C-suite expects unfavorable volatility to continue, with emerging markets demand and political instability topping the list of concerns. Most feel their organizations are unprepared to respond effectively. Demand volatility – misfi ring engines of growth Cost volatility – business as usual Political, economic and regulatory volatility Slowdown in BRICS Currency and raw Political uncertainties (assuming this includes material price and product regulations South Africa), emerging 58% fl uctuations are 58% around the globe are the 72% markets, and concerns expected to have biggest concerns, but the expect unfavorable political, around Eurozone expect unfavorable negative impact, but expect unfavorable C-suites feel signifi cantly economic and regulatory outweigh the positive demand volatility considered more of an cost volatility under-prepared for the volatility outlook of the C-suite for operational issue. former. North America. Only Only 19% Only 18% 25% feel well-prepared for feel well-prepared for feel well-prepared for demand volatility cost volatility political, economic and regulatory volatility 50% of respondents selected demand from 52% of respondents selected currency 43% of manufacturers selected product- BRICS and emerging markets exchange rates related regulations 56% of them cited negative impact, up from 20% a 67% of them cited negative impact, down from 78% 58% of them cited negative impact, while year ago a year ago preparedness has improved 50% of them also facing headwinds from Eurozone of respondents selected raw material 34% prices, 2/3 stated negative impact 50% of automakers selected political 1/3 of suppliers identifi ed forecasting disputes and economic sanctions accuracy of automakers None of them are well-prepared 83% of them cited negative impact, up from 55% a year ago 4 | Changing lanes 2015-16 | The automotive C-suite’s agenda

Changing Lanes Page 3 Page 5

Changing Lanes Page 3 Page 5