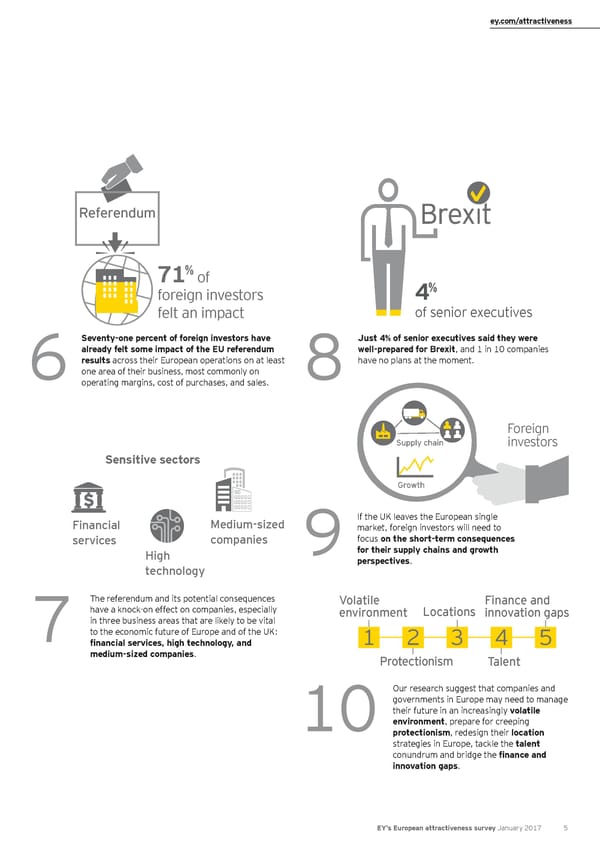

ey.com/attractiveness International companies 56% foreign investors Referendum 86% % % 71 of % 14 foreign investors 4 felt an impact of senior executives Fifty-six percent of foreign investors plan to invest Relocation may happen: 86% of international Seventy-one percent of foreign investors have Just 4% of senior executives said they were in Europe in the next three years, a remarkable sign companies active in the UK say they plan to stay; already felt some impact of the EU referendum well-prepared for Brexit, and 1 in 10 companies of investor optimism despite an uncertain political and 14% will transfer some or all of their activities results across their European operations on at least have no plans at the moment. 1business climate.4elsewhere. The UK’s attractiveness will be affected 6one area of their business, most commonly on 8 by Brexit, but its competitive advantages remain operating margins, cost of purchases, and sales. strong and may strengthen somewhat if the Government improves incentives in key areas. Yet, we expect an uptick in relocations Europe-wide, driven by diverse deep trends, including technology Foreign change and corporate competition. Supply chain investors Sensitive sectors Main alternative destinations Growth 1 #1Germany If the UK leaves the European single Financial Medium-sized market, foreign investors will need to risk234 services companies focus on the short-term consequences European instability is the boardroom’s number-one France Ireland Netherlands High 9for their supply chains and growth cause for risk: Global economic volatility (highlighted technology perspectives. by 37% of our respondents) and the fragmentation of 2Europe (32%) are the biggest worries for the continent’s investors. The referendum and its potential consequences Volatile Finance and have a knock-on effect on companies, especially environment Locations innovation gaps in three business areas that are likely to be vital 7to the economic future of Europe and of the UK: 1 2 3 4 5 financial services, high technology, and medium-sized companies. Protectionism Talent #3The lines of Europe's FDI map are starting to shift: Germany is the UK’s main challenger for the concerntop spot, while France, Ireland and the Netherlands Our research suggest that companies and 5are more distant competitors. But it is not just a governments in Europe may need to manage Brexit is third on the list of concerns but it’s a competition between countries: European cities are their future in an increasingly volatile much bigger worry for foreign companies established increasingly competing to attract cross-border 10environment, prepare for creeping in the UK (33%) than for those that are not (15%). investment. protectionism, redesign their location 3For those not established in the UK, geopolitical and strategies in Europe, tackle the talent wider EU instability and the slowdown in trade flows conundrum and bridge the finance and are more urgent concerns. innovation gaps. EY’s European attractiveness survey January 2017 5

European attractiveness survey January 2017 Page 7 Page 9

European attractiveness survey January 2017 Page 7 Page 9