European attractiveness survey January 2017

EY’s European attractiveness survey January 2017 Plan B … for Brexit A boardroom view on investment and location strategies in Europe

EY’s attractiveness surveys and program around the world EY’s attractiveness surveys are widely recognized by our clients, media and major public stakeholders as a key source of insight into foreign direct investment (FDI). Examining the attractiveness of a particular region or country as an investment destination, the surveys are designed to help businesses make investment decisions and governments remove barriers to growth. A two-step methodology analyzes both the reality and perception of FDI in the country or region. Findings are based on the views of representative panels of international and local opinion leaders and decision-makers. The program has a 16-year legacy and has produced in-depth studies for Europe, a large number of European countries, Africa, India, South America and Kazakhstan. For more information, please visit: ey.com/attractiveness Twitter: @EY_FDI An attractive future EY UK Attractiveness Survey — Autumn 2016 An attractive Our long history of sponsorship of research into UK trade, future including foreign direct investment (FDI), stems from our EY’s UK Attractiveness Survey, Autumn 2016 Executive summary desire to encourage an open dialogue between business leaders, investors and policy makers on how to maximise the UK’s economic performance. FDI has been an important source of capability for the UK in recent years especially as investment as a share of gross domestic product (GDP) has lagged the UK’s developed country peers. Our 2016 UK Attractiveness Survey published in May, confi rmed another year of strong performance in attracting FDI to the UK. It did however also identify an increased level of uncertainty about the future attractiveness of the UK. We have updated our investor perceptions survey in the Autumn to compare the mood with that in the Spring 2016. The results of this work together with a detailed analysis of FDI in Europe over the last decade provide the basis for the proposals set out in this report. For more information, please visit ey.com/ukas

ey.com/attractiveness 02 How we designed the research 03 An EY survey on foreign investment decisions in Europe and the prospect of Brexit 04 Ten lessons learned from listening to foreign investors in Europe 06 Foreign investors are keen on Europe, yet cautious 12 A rethink of pan-European investments and activities is looming 19 Foreign investors in Europe are focused on managing the present — for now 24 A longer-term agenda for businesses and governments in Europe EY’s European attractiveness survey January 2017 1

How EY designed the research In November 2016, we interviewed 254 senior business executives 67% had annual revenues of less than €1.5b, ensuring a broad representing firms with foreign investments in Europe. We divided spread of perspectives. This proportion is representative of their our sample group into three groups of approximately equal size, share of the FDI population in Europe at the time of our survey. based on whether their companies had their global headquarters in North America, in Asia or in Europe. Our sample group drew from This survey dovetails with the long-running European attractiveness a wide range of sectors. It included foreign investors in diversified survey conducted by EY’s Europe, Middle-East, India and Africa Industrial products, automotive, consumer goods, high technology, (EMEIA) Region, which studies the forces shaping flows of Foreign and the pharmaceutical and chemical industries, as well as investors direct investment (FDI) into Europe. Our European region extends in business services and financial services. In order to obtain the from Gibraltar to Iceland and from Portugal to Russia and Turkey, 1 most direct perspective on Brexit, 128 senior executives were embracing the 28 states of the European Union (EU28 ), and their interviewed in the UK. The other 126 were reached in continental neighbors. To signify the EU minus the United Kingdom, we refer Europe, North America or Asia. Within our panel of companies, 2 to the EU27. Sector of activity Global headquarters Size (in annual sales) Diversified North America Europe 33%more than €1.5b industrial products, 23% Asia automotive and energy 33% 34% 33% 33% between €150m and €1.5b Retail, consumer goods and pharmaceuticals 23% 34% less than €150m Financial services 20% Business services Location of interviewee Presence in the UK (including transport 18% and logistics) High technology 51% in the UK 75% present in the UK (including software, telecoms and biotech) 16% 49% outside the UK 25%not present in the UK We also interviewed more than 50 EY professionals who together • How their clients are reacting to the situation have in-depth knowledge of many sectors, competencies and • What their clients’ most pressing concerns are geographies. We did not ask them about the politics of post- • How companies are preparing for the emergence of a referendum or pre-Brexit preparation, but rather about the real substantially different relationship between the UK and its business implications and the impact on corporate agendas. We continental neighbors. asked them to share their experiences and to tell us: • How companies are managing ongoing uncertainty — not only We want to extend our gratitude to the C-suite executives and EY limited to Brexit, but also relating to instability elsewhere in Europe professionals who shared their insights. and to concerns about present and future international growth 1 EU28 refers to all 28 member states of the European Union i.e., Austria, Belgium, Bulgaria, 2 EU27 refers to the 27 member states of the European Union excluding the UK. Croatia, Cyprus, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden and the UK. 2 EY’s European attractiveness survey January 2017

ey.com/attractiveness An EY survey on foreign investment decisions in Europe and the prospect of Brexit This report is part of a series by EY on the attractiveness of Europe and European countries for cross-border investments. Since 2000, this series has provided information on international location strategies and their impact on countries and cities in Europe. The global political, economic and investment landscape has a free trade agreement (FTA) with the EU. But continuing full entered an exceptional period of transition. In the US, newly membership of the single market was not an option. The UK appointed President Donald Trump has promised to recast US Government wishes to balance the needs of the UK economy with policies in ways likely to have profound effects both on the US the desire for control of borders and laws expressed by its citizens. economy and upon investment flows in the US and worldwide. EU leaders are clear and consistent that membership of the single market is incompatible with restrictions on the free movement of The tectonic plates of our multi-polar world are shifting. Companies their citizens. Business leaders must start preparing their analyses from China, India and other newer markets are continuing to and plans for life after Brexit. To help them in this process, expand on a world stage. Europe is changing too. This year will EY commissioned a survey to investigate what impact the see elections in the Netherlands, France and Germany which may referendum and resulting uncertainties are having upon foreign have far-reaching policy implications. Investors see uncertainty direct investors and their European ambitions. everywhere. As the year advances, EY’s European Attractiveness survey will aim to capture more outcomes and assess implications. Foreign direct investment (FDI) is vital to the economic well-being of the UK and the rest of Europe. The impact of Brexit on Our first step, however, is this attempt to look at the impact of investment mobility and location is therefore a critical issue for the UK’s historic decision to leave the European Union upon the companies and policy-makers. Last year, foreign investors made European investment landscape within this backdrop of continent- 5,083 decisions to set up or expand operations in Europe, building 6 wide change. or renewing productive assets and creating 217,666 jobs. Historically, the UK has been Europe’s top FDI destination. On 23 June 2016, the citizens of the UK voted by 51.9% to 48.1% According to our calculations, the UK secured a record 1,065 FDI 3 for their country to leave the European Union (EU). The UK projects in 2015 (20.9% of the European total), which created over 7 Government has said it expects to invoke Article 50 of the EU’s 40,000 jobs in the country in that year. Lisbon Treaty and thereby trigger negotiations with the remaining 27 EU member states in March 2017.4 Michel Barnier, the Chief There appears to be a growing likelihood that companies located Negotiator appointed by the European Commission to handle the in the UK will lose seamless access to the single market. And it 5 process, has said that a deal must be struck by October 2018. also appears likely that some companies — and not just those in The transition will coincide with wider changes in the political the financial services sector — will reshape, transfer, downsize or landscape as President Donald Trump begins to recast US policies. transform some of their operations both in the UK and sometimes, in consequence, elsewhere in Europe. However, some business Implementing Brexit will be extraordinarily complex. On leaders have already said that the current context will not change 17 January, Theresa May, the UK Prime Minister, said she hopes their plans to invest in the UK. to retain partial membership of the customs union, backed by Andy Baldwin Hanne-Jesca Bax Marc Lhermitte EY EMEIA Area Managing Partner EY EMEIA Managing Partner EY Advisory, Global Lead Attractiveness Markets & Accounts and Competitiveness 3 “EU referendum results and maps,” The Telegraph website, http://www.telegraph.co.uk/ news/2016/06/23/leave-or-remain-eu-referendum-results-and-live-maps/, accessed 1 January 5 “EU sees Oct 2018 Brexit deal,” Reuters website, http://in.reuters.com/article/britain-eu-barnier- 2017. idINKBN13V1DN, accessed 3 January 2017 4 “Theresa May to trigger article 50 by end of March 2017,” The Guardian website, https:// 6 European attractiveness survey 2016, EY, 2016 www.theguardian.com/politics/2016/oct/01/theresa-may-to-propose-great-repeal-bill-to-unwind- eu-laws, accessed 1 January 2017. 7 UK attractiveness survey 2016, EY, 2016. EY’s European attractiveness survey January 2017 3

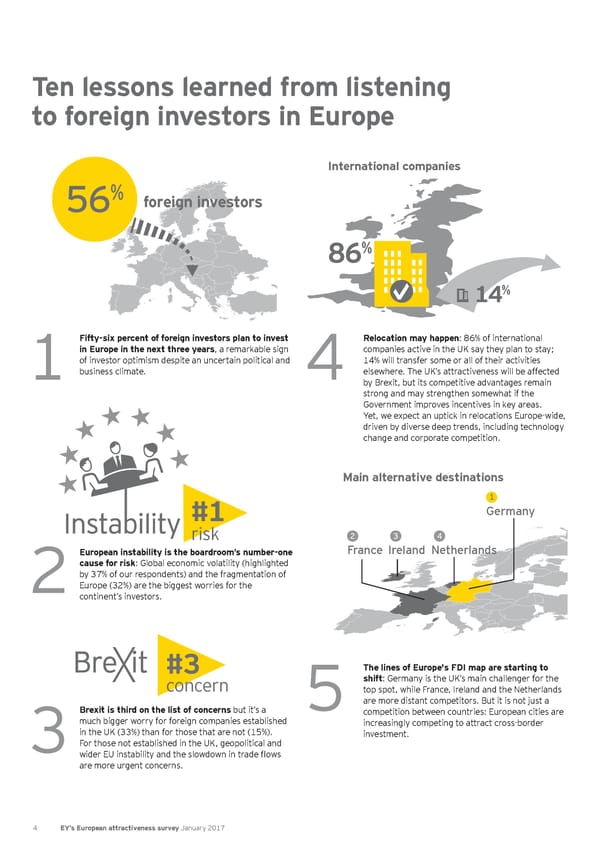

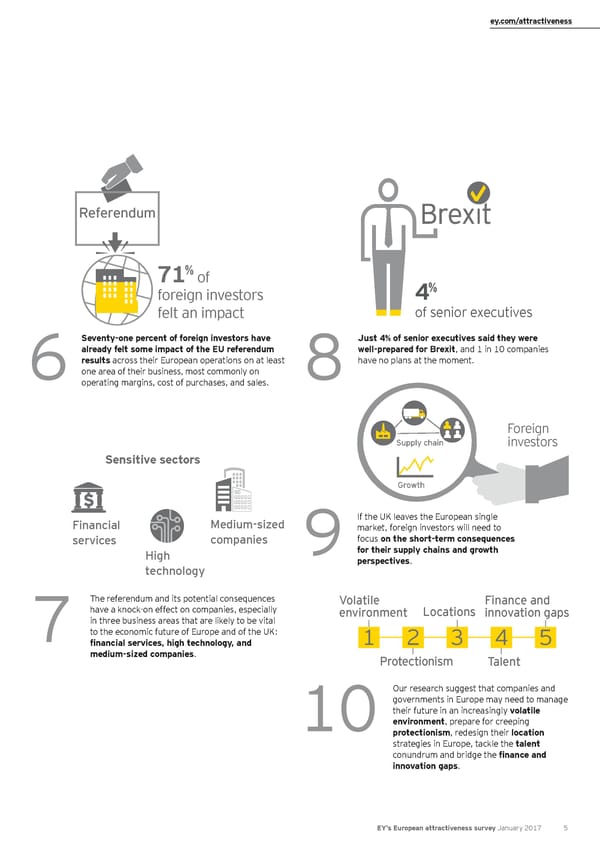

Ten lessons learned from listening to foreign investors in Europe International companies 56% foreign investors Referendum 86% % % 71 of % 14 foreign investors 4 felt an impact of senior executives Fifty-six percent of foreign investors plan to invest Relocation may happen: 86% of international Seventy-one percent of foreign investors have Just 4% of senior executives said they were in Europe in the next three years, a remarkable sign companies active in the UK say they plan to stay; already felt some impact of the EU referendum well-prepared for Brexit, and 1 in 10 companies of investor optimism despite an uncertain political and 14% will transfer some or all of their activities results across their European operations on at least have no plans at the moment. 1business climate. 4elsewhere. The UK’s attractiveness will be affected 6one area of their business, most commonly on 8 by Brexit, but its competitive advantages remain operating margins, cost of purchases, and sales. strong and may strengthen somewhat if the Government improves incentives in key areas. Yet, we expect an uptick in relocations Europe-wide, driven by diverse deep trends, including technology Foreign change and corporate competition. Supply chain investors Sensitive sectors Main alternative destinations Growth 1 #1 Germany If the UK leaves the European single Financial Medium-sized market, foreign investors will need to risk 2 3 4 services companies focus on the short-term consequences European instability is the boardroom’s number-one France Ireland Netherlands High 9for their supply chains and growth cause for risk: Global economic volatility (highlighted technology perspectives. by 37% of our respondents) and the fragmentation of 2Europe (32%) are the biggest worries for the continent’s investors. The referendum and its potential consequences Volatile Finance and have a knock-on effect on companies, especially environment Locations innovation gaps in three business areas that are likely to be vital 7to the economic future of Europe and of the UK: 1 2 3 4 5 financial services, high technology, and medium-sized companies. Protectionism Talent #3 The lines of Europe's FDI map are starting to shift: Germany is the UK’s main challenger for the concern top spot, while France, Ireland and the Netherlands Our research suggest that companies and 5are more distant competitors. But it is not just a governments in Europe may need to manage Brexit is third on the list of concerns but it’s a competition between countries: European cities are their future in an increasingly volatile much bigger worry for foreign companies established increasingly competing to attract cross-border 10environment, prepare for creeping in the UK (33%) than for those that are not (15%). investment. protectionism, redesign their location 3For those not established in the UK, geopolitical and strategies in Europe, tackle the talent wider EU instability and the slowdown in trade flows conundrum and bridge the finance and are more urgent concerns. innovation gaps. 4 EY’s European attractiveness survey January 2017

ey.com/attractiveness International companies 56% foreign investors Referendum 86% % % 71 of % 14 foreign investors 4 felt an impact of senior executives Fifty-six percent of foreign investors plan to invest Relocation may happen: 86% of international Seventy-one percent of foreign investors have Just 4% of senior executives said they were in Europe in the next three years, a remarkable sign companies active in the UK say they plan to stay; already felt some impact of the EU referendum well-prepared for Brexit, and 1 in 10 companies of investor optimism despite an uncertain political and 14% will transfer some or all of their activities results across their European operations on at least have no plans at the moment. 1business climate.4elsewhere. The UK’s attractiveness will be affected 6one area of their business, most commonly on 8 by Brexit, but its competitive advantages remain operating margins, cost of purchases, and sales. strong and may strengthen somewhat if the Government improves incentives in key areas. Yet, we expect an uptick in relocations Europe-wide, driven by diverse deep trends, including technology Foreign change and corporate competition. Supply chain investors Sensitive sectors Main alternative destinations Growth 1 #1Germany If the UK leaves the European single Financial Medium-sized market, foreign investors will need to risk234 services companies focus on the short-term consequences European instability is the boardroom’s number-one France Ireland Netherlands High 9for their supply chains and growth cause for risk: Global economic volatility (highlighted technology perspectives. by 37% of our respondents) and the fragmentation of 2Europe (32%) are the biggest worries for the continent’s investors. The referendum and its potential consequences Volatile Finance and have a knock-on effect on companies, especially environment Locations innovation gaps in three business areas that are likely to be vital 7to the economic future of Europe and of the UK: 1 2 3 4 5 financial services, high technology, and medium-sized companies. Protectionism Talent #3The lines of Europe's FDI map are starting to shift: Germany is the UK’s main challenger for the concerntop spot, while France, Ireland and the Netherlands Our research suggest that companies and 5are more distant competitors. But it is not just a governments in Europe may need to manage Brexit is third on the list of concerns but it’s a competition between countries: European cities are their future in an increasingly volatile much bigger worry for foreign companies established increasingly competing to attract cross-border 10environment, prepare for creeping in the UK (33%) than for those that are not (15%). investment. protectionism, redesign their location 3For those not established in the UK, geopolitical and strategies in Europe, tackle the talent wider EU instability and the slowdown in trade flows conundrum and bridge the finance and are more urgent concerns. innovation gaps. EY’s European attractiveness survey January 2017 5

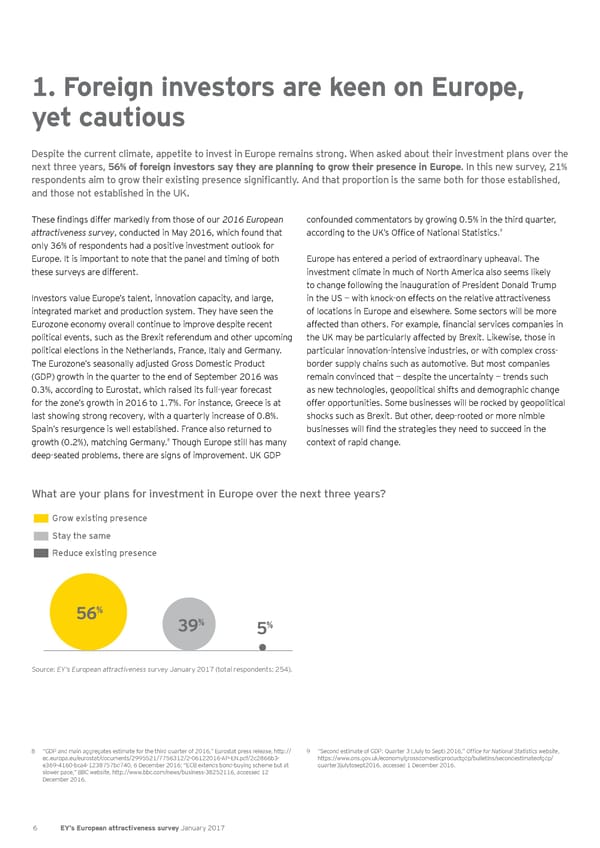

1. Foreign investors are keen on Europe, yet cautious Despite the current climate, appetite to invest in Europe remains strong. When asked about their investment plans over the next three years, 56% of foreign investors say they are planning to grow their presence in Europe. In this new survey, 21% respondents aim to grow their existing presence significantly. And that proportion is the same both for those established, and those not established in the UK. These findings differ markedly from those of our 2016 European confounded commentators by growing 0.5% in the third quarter, 9 attractiveness survey, conducted in May 2016, which found that according to the UK’s Office of National Statistics. only 36% of respondents had a positive investment outlook for Europe. It is important to note that the panel and timing of both Europe has entered a period of extraordinary upheaval. The these surveys are different. investment climate in much of North America also seems likely to change following the inauguration of President Donald Trump Investors value Europe’s talent, innovation capacity, and large, in the US — with knock-on effects on the relative attractiveness integrated market and production system. They have seen the of locations in Europe and elsewhere. Some sectors will be more Eurozone economy overall continue to improve despite recent affected than others. For example, financial services companies in political events, such as the Brexit referendum and other upcoming the UK may be particularly affected by Brexit. Likewise, those in political elections in the Netherlands, France, Italy and Germany. particular innovation-intensive industries, or with complex cross- The Eurozone’s seasonally adjusted Gross Domestic Product border supply chains such as automotive. But most companies (GDP) growth in the quarter to the end of September 2016 was remain convinced that — despite the uncertainty — trends such 0.3%, according to Eurostat, which raised its full-year forecast as new technologies, geopolitical shifts and demographic change for the zone’s growth in 2016 to 1.7%. For instance, Greece is at offer opportunities. Some businesses will be rocked by geopolitical last showing strong recovery, with a quarterly increase of 0.8%. shocks such as Brexit. But other, deep-rooted or more nimble Spain’s resurgence is well established. France also returned to businesses will find the strategies they need to succeed in the growth (0.2%), matching Germany.8 context of rapid change. Though Europe still has many deep-seated problems, there are signs of improvement. UK GDP What are your plans for investment in Europe over the next three years? Grow existing presence Stay the same Reduce existing presence 56% % % 39 5 Source: EY’s European attractiveness survey January 2017 (total respondents: 254). 8 “GDP and main aggregates estimate for the third quarter of 2016,” Eurostat press release, http:// 9 “Second estimate of GDP: Quarter 3 (July to Sept) 2016,” Office for National Statistics website, ec.europa.eu/eurostat/documents/2995521/7756312/2-06122016-AP-EN.pdf/2c2866b3- https://www.ons.gov.uk/economy/grossdomesticproductgdp/bulletins/secondestimateofgdp/ e369-4160-bca4-1238757bd740, 6 December 2016; “ECB extends bond-buying scheme but at quarter3julytosept2016, accessed 1 December 2016. slower pace,” BBC website, http://www.bbc.com/news/business-38252116, accessed 12 December 2016. 6 EY’s European attractiveness survey January 2017

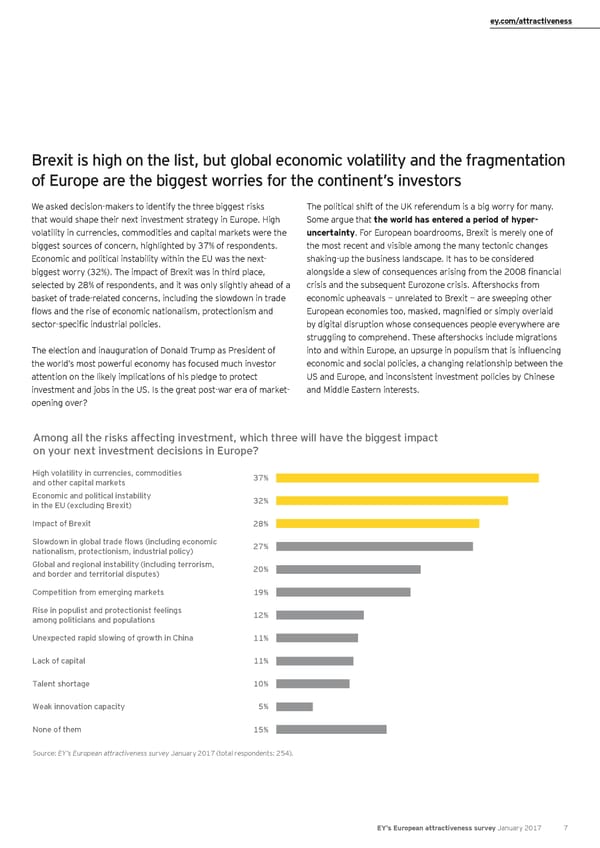

ey.com/attractiveness Brexit is high on the list, but global economic volatility and the fragmentation of Europe are the biggest worries for the continent’s investors We asked decision-makers to identify the three biggest risks The political shift of the UK referendum is a big worry for many. that would shape their next investment strategy in Europe. High Some argue that the world has entered a period of hyper- volatility in currencies, commodities and capital markets were the uncertainty. For European boardrooms, Brexit is merely one of biggest sources of concern, highlighted by 37% of respondents. the most recent and visible among the many tectonic changes Economic and political instability within the EU was the next- shaking-up the business landscape. It has to be considered biggest worry (32%). The impact of Brexit was in third place, alongside a slew of consequences arising from the 2008 financial selected by 28% of respondents, and it was only slightly ahead of a crisis and the subsequent Eurozone crisis. Aftershocks from basket of trade-related concerns, including the slowdown in trade economic upheavals — unrelated to Brexit — are sweeping other flows and the rise of economic nationalism, protectionism and European economies too, masked, magnified or simply overlaid sector-specific industrial policies. by digital disruption whose consequences people everywhere are struggling to comprehend. These aftershocks include migrations The election and inauguration of Donald Trump as President of into and within Europe, an upsurge in populism that is influencing the world’s most powerful economy has focused much investor economic and social policies, a changing relationship between the attention on the likely implications of his pledge to protect US and Europe, and inconsistent investment policies by Chinese investment and jobs in the US. Is the great post-war era of market- and Middle Eastern interests. opening over? Among all the risks affecting investment, which three will have the biggest impact on your next investment decisions in Europe? High volatility in currencies, commodities 37% and other capital markets Economic and political instability 32% in the EU (excluding Brexit) Impact of Brexit 28% Slowdown in global trade flows (including economic 27% nationalism, protectionism, industrial policy) Global and regional instability (including terrorism, 20% and border and territorial disputes) Competition from emerging markets 19% Rise in populist and protectionist feelings 12% among politicians and populations Unexpected rapid slowing of growth in China 11% Lack of capital 11% Talent shortage 10% Weak innovation capacity 5% None of them 15% Source: EY’s European attractiveness survey January 2017 (total respondents: 254). EY’s European attractiveness survey January 2017 7

Foreign investors are keen on Europe, yet cautious EY point of view Since then, however, investors have lost much of their confidence Negotiations ahead in Europe’s ability to weather post-crisis storms. Amid an upsurge UK companies need to have realistic expectations for the Exit Treaty of populism, investors have noted Italy’s rejection of political negotiations. The process will be intensely political. UK Prime Minister reforms, and the presidential and parliamentary elections Theresa May will seek outcomes that achieve her objectives. Yet looming in 2017 in France, the Netherlands, Italy and Germany. the goals of EU negotiators will be to achieve what they believe best Events in Poland, Hungary and Austria have also caused unease. for the EU. That includes ensuring that club membership remains The possibility of other dramatic policy changes, in a region attractive. They must avoid a crisis for the EU itself, so the European hitherto regarded as a bastion of stability, transparency and good Commission’s goal will be to keep the 27 member states aligned. But governance, is deeply unsettling for investors. for purely domestic reasons, the member states are likely to have divergent priorities. Given the UK red line on regaining control over its borders, continuing UK access to the EU Internal Market, as it stands Today, the EU could be weakening its biggest competitive today, is looking far from certain. Companies need to plan accordingly. advantage in the global contest to secure foreign investment (5,083 decisions by foreign investors to invest in Europe in Jeremy Jennings 2015 alone10 ). In EY’s 2015 European attractiveness survey, EY EMEIA Regulatory and Public Policy Leader decision-makers made clear that stability and predictability are the most critical factors underpinning their investment decisions, and they singled out Europe’s stable and predictable business environment as its strongest attractiveness feature. Flashback to 2015: key criteria for investors to select a location and Europe’s features they valued the most What do investors want? What do they like about Europe? 1 Stability and transparency of political, legal and regulatory environment (46%) 1 Stable and predictable business environment (49%) 2 The country’s or region's domestic market (37%) 2 Research and innovation capacity (35%) 3 Transport and logistics infrastructure (30%) 3 Market size (31%) 4 Potential productivity increase for their company (29%) 4 Diversity and quality of labor force (31%) 5 Labor costs (24%) 5 High purchasing power (19%) 6 Local labor skill level (22%) Percentage weight given by the investors to that particular factor. Source: EY’s 2015 European attractiveness survey (total respondents: 808). 10 EY’s European attractiveness survey 2016. 8 EY’s European attractiveness survey January 2017

ey.com/attractiveness EY point of view Make the EU relevant again Brexit is a national democratic choice. From now on, the actions of the What are the priority EU policies needed to enhance the attractiveness of UK authorities and the EU member states need to be developed with a EU member states in the next three to five years? strict respect for the popular will. The Brexit process needs to be framed • Improving the investment climate, expanding the existing “Juncker within a clear and positive plan of action in the context of representative Plan” democracy. From a European perspective, despite growing Euro- skepticism, we must guard against the idea that Brexit is the start of an • Securing banking and capital market union unraveling of the EU. Brexit is primarily an additional political challenge • Creating a digital single market for the EU, alongside the migration crisis, the Eurozone troubles, unemployment, among others. National and European authorities need • Enhancing common migration, security and defense policies to focus more than ever on these pressing challenges, by stressing why Even without the UK, the EU will be home to 6% of the world’s we are stronger together. population. European leaders and institutions need to move away from their current fire-fighting mode to better respond to their citizens’ and businesses’ needs and to stay relevant in this globalized world. Alessandro Cenderello EY EU Institutions Leader EY’s European attractiveness survey January 2017 9

Foreign investors are keen on Europe, yet cautious More active investment strategies in Europe for financial services, high technology and medium-sized companies The details of Brexit are unclear, but the current economic and political climate may have a strong impact on the investment strategies of financial services and technology-intensive companies, as well as on mid-sized companies which constitute a third of our survey group. Foreign investment plans in Europe: sector variations EY point of view: financial services on a theme Preparation time Grow existing presence London is currently the center of financial services in Europe and we Stay the same expect that to continue in the foreseeable future. However many firms Reduce existing presence may need a physical EU27 nexus for some of their activities if they are to retain EU clients after a Brexit. Obtaining regulatory authorizations can be a slow process. Firms with a large EU27 clientele are already exploring possible locations to set up an EU27 subsidiary and are in discussions with regulatory 56% authorities on obtaining the approvals necessary to continue serving % % clients within the single market. 39 5 Recently, the European Commission proposed that banks headquartered in non-EU countries will be required to set up an Overall Foreign Direct Investors (254 respondents) intermediate holding company for their subsidiaries in the EU. As the UK is expected to become a non-EU country, this has increased the urgency for banks to address the consequences of Brexit. Many large investment banks fear that Euro clearing operations and derivative transactions worth over US$500 billion may shift from 52% London to other EU countries. % % 42 6 In expectation of the increased investment, EU countries including Ireland, France, Germany and Spain are simplifying regulatory application procedures and wooing London-based financial services Financial services Foreign Direct Investors firms. Frankfurt is considering relaxing labor laws. The extent of any (50 respondents) moves may ultimately depend upon the terms of any exit agreement between the EU and the UK, but companies must plan for the worst and hope for the best. Marcel Van Loo 72% EY EMEIA Financial Services, Regional Managing Partner % 18 10% Tech-intensive Foreign Direct Investors (35 respondents) 69% % % 28 3 Mid-size Foreign Direct Investors (85 respondents) Source: EY’s European attractiveness survey January 2017 (total respondents: 254). 10 EY’s European attractiveness survey January 2017

ey.com/attractiveness • Financial services companies are understandably less EY point of view: technology optimistic about their growth prospects in Europe than the sample average. Only 12% expect strong growth, compared Digital agility with 21% of companies overall, and 6% expect to reduce their existing presence slightly. They are nearly twice as likely as The digital economy accounts for over 10% of Britain’s GDP. And it is manufacturing firms to identify EU instability (51%) and Brexit growing fast, both in the UK and across the EU. Investment in tech (41%) among the top three risks to their growth. For them, start-ups now tops US$13.6b in the UK and Europe — up fivefold in volatility is seen as a much less severe risk. five years. But since the referendum, financial technology (FinTech) investments have slumped 26% to US$532m in the third quarter of Their reasons are clear: London is the center of financial 2016 — running at almost half the pace seen during 2015. services in Europe, and many companies there fear business The UK has Europe’s strongest start-up ecosystem, centered in the disruption arising from Brexit. Financial services firms in London London district of Shoreditch, but spilling out into high-tech centers face a number of risks, including the potential loss of so-called around the university cities of Oxford and Cambridge. European “passporting rights.” These rights allow a financial services firm cities — notably Dublin, Paris and Berlin — see the referendum result as regulated by one EU state to sell services in the other 27 states a chance to promote themselves as alternative technology hubs. without acquiring additional authorizations. If passporting rights Key issues for tech entrepreneurs and investors revolve around talent are withdrawn, firms may be obliged to relocate some operations and mobility, data flow and data privacy regulation, tax and trade to EU27 countries in order to continue trading within the EU. rules, and access to finance. • Technology firms are by far the most bullish. Overall, 72% The EU is a leading source of funds for UK research, innovation and plan to invest in Europe in the next three years, and of these, SME projects through programs such as Horizon 2020, which aims 33% expect to grow their presence significantly. That is very to achieve nearly €80 billion of investments by 2020. Fears that good news in a continent that has so far been unable to give rise funding may be harder to obtain may be making venture capital firms to a digital technology firm equal to the giants of Silicon Valley. more cautious. However, US global technology giants have continued to demonstrate their confidence in London as a digital technology Well-established tech firms seem untroubled by instability in powerhouse. Europe, yet the tech firms we surveyed are nearly as worried about Brexit (38%) as those in financial services. They are Jean-Benoit Berty much less bothered about instability in the EU (24%), but 60% EY UK Technology, Media and Telecommunications Sector are alarmed at volatility in commodities, currencies and capital Leader markets. One explanation may be that young tech firms rely heavily upon external funding, and fear that their financing Source: “UK’s digital economy is world leading in terms of proportion of GDP,” ecosystem could be upset by Brexit. TechUK.org website, https://www.techuk.org/insights/news/item/4075-uk-s- digital-economy-is-world-leading-in-terms-of-proportion-of-gdp, accessed 12 Despite its poor performance in building consumer-oriented December 2016; “Action is needed now to stem the flow of vital technology talent,” The Times website, http://www.thetimes.co.uk/article/action-is- digital champions, Europe is widely seen as a powerhouse needed-now-to-stem-the-flow-of-vital-technology-talent-8dnqbqt5k, accessed in emerging technologies such as artificial intelligence, the 9 December 2016. “Brexit depression casts dark cloud over UK fintech investment,” Finextra website, https://www.finextra.com/newsarticle/29772/ internet of things and robotics. The continent, on both sides brexit-depression-casts-dark-cloud-over-uk-fintech-investment, accessed 9 of the English Channel, has produced many promising young December 2016; “European Social Fund 2014–2020,” European Commission website, http://ec.europa.eu/esf/main.jsp?catId=62, accessed 9 December 2016. companies in these fields, and hosts powerful ecosystems underpinned by close links between industry and academia. • Mid-sized companies will continue to seek growth in Europe. More than two-thirds expect to grow their presence in Europe, and 26% plan significant expansion. For them, it is volatility in currency and commodity markets that poses the biggest business risk, with the slowdown in trade flows, and Brexit in second and third places. EY’s European attractiveness survey January 2017 11

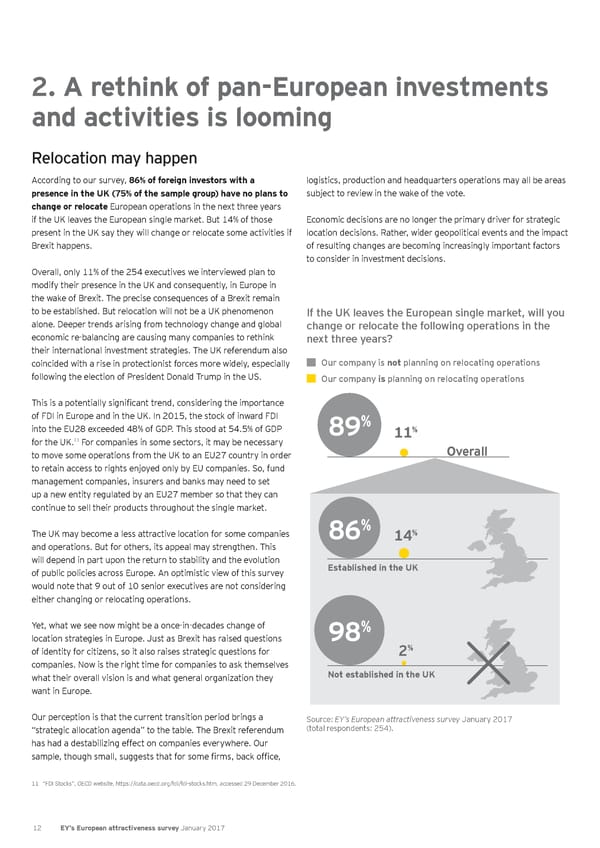

2. A rethink of pan-European investments and activities is looming Relocation may happen According to our survey, 86% of foreign investors with a logistics, production and headquarters operations may all be areas presence in the UK (75% of the sample group) have no plans to subject to review in the wake of the vote. change or relocate European operations in the next three years if the UK leaves the European single market. But 14% of those Economic decisions are no longer the primary driver for strategic present in the UK say they will change or relocate some activities if location decisions. Rather, wider geopolitical events and the impact Brexit happens. of resulting changes are becoming increasingly important factors to consider in investment decisions. Overall, only 11% of the 254 executives we interviewed plan to modify their presence in the UK and consequently, in Europe in the wake of Brexit. The precise consequences of a Brexit remain to be established. But relocation will not be a UK phenomenon If the UK leaves the European single market, will you alone. Deeper trends arising from technology change and global change or relocate the following operations in the economic re-balancing are causing many companies to rethink next three years? their international investment strategies. The UK referendum also coincided with a rise in protectionist forces more widely, especially Our company is not planning on relocating operations following the election of President Donald Trump in the US. Our company is planning on relocating operations This is a potentially significant trend, considering the importance of FDI in Europe and in the UK. In 2015, the stock of inward FDI % into the EU28 exceeded 48% of GDP. This stood at 54.5% of GDP 89 11% for the UK.11 For companies in some sectors, it may be necessary Overall to move some operations from the UK to an EU27 country in order to retain access to rights enjoyed only by EU companies. So, fund management companies, insurers and banks may need to set up a new entity regulated by an EU27 member so that they can continue to sell their products throughout the single market. The UK may become a less attractive location for some companies 86% 14% and operations. But for others, its appeal may strengthen. This will depend in part upon the return to stability and the evolution Established in the UK of public policies across Europe. An optimistic view of this survey would note that 9 out of 10 senior executives are not considering either changing or relocating operations. Yet, what we see now might be a once-in-decades change of 98% location strategies in Europe. Just as Brexit has raised questions of identity for citizens, so it also raises strategic questions for % 2 companies. Now is the right time for companies to ask themselves what their overall vision is and what general organization they Not established in the UK want in Europe. Our perception is that the current transition period brings a Source: EY’s European attractiveness survey January 2017 “strategic allocation agenda” to the table. The Brexit referendum (total respondents: 254). has had a destabilizing effect on companies everywhere. Our sample, though small, suggests that for some firms, back office, 11 “FDI Stocks”, OECD website, https://data.oecd.org/fdi/fdi-stocks.htm, accessed 29 December 2016. 12 EY’s European attractiveness survey January 2017

ey.com/attractiveness EY point of view: automotive Sustaining performance As we do not know yet when, how and under what conditions a Brexit costs and in order to adapt to new technology and changes, such as the will be executed, it will remain important to think in scenarios and to spread of electric cars and the emergence of ride-sharing business models. build maximum flexibility and agility in any strategic programs. The The devaluation of the sterling has already undermined the margins of automotive industry faces significant uncertainty as Brexit unfolds. The car-makers selling into the UK. Several companies have raised prices and UK is the fourth-largest light vehicle manufacturer in Western Europe. begun cost-control measures. Higher prices are likely to cut demand in In the first half of 2016, UK output was 897,157 cars, up 13% year-on- the UK. year. The UK industry is closely integrated with that of the Eurozone both in terms of component supply and sales. EU customers are big buyers of We believe that uncertainty does not mean “wait and see.” Companies British-made cars, and the UK is a leading market for vehicles imported that fail to act will cede a strategic advantage. We recommend that from Germany, Spain, France, the Czech Republic, and elsewhere. carmakers increase scenario planning and develop agility. Supplies of components flow back and forth across the Channel. Now Brexit hangs over a European car industry that already has excess Jörg Hönemann vehicle-manufacturing capacity, and is reshaping itself in search of lower EY Germany, Austria and Switzerland (GSA), Automotive team leader EY’s European attractiveness survey January 2017 13

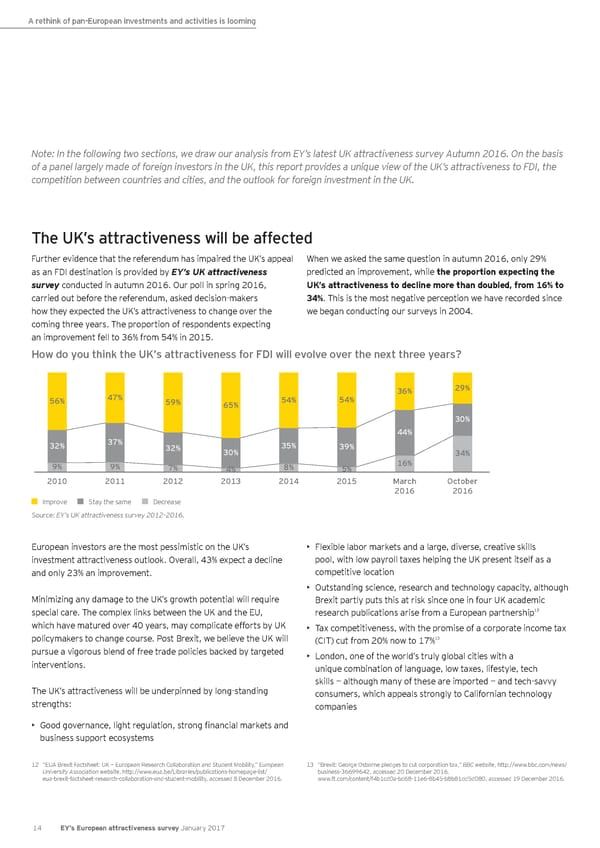

A rethink of pan-European investments and activities is looming Note: In the following two sections, we draw our analysis from EY’s latest UK attractiveness survey Autumn 2016. On the basis of a panel largely made of foreign investors in the UK, this report provides a unique view of the UK’s attractiveness to FDI, the competition between countries and cities, and the outlook for foreign investment in the UK. The UK’s attractiveness will be affected Further evidence that the referendum has impaired the UK’s appeal When we asked the same question in autumn 2016, only 29% as an FDI destination is provided by EY’s UK attractiveness predicted an improvement, while the proportion expecting the survey conducted in autumn 2016. Our poll in spring 2016, UK’s attractiveness to decline more than doubled, from 16% to carried out before the referendum, asked decision-makers 34%. This is the most negative perception we have recorded since how they expected the UK’s attractiveness to change over the we began conducting our surveys in 2004. coming three years. The proportion of respondents expecting an improvement fell to 36% from 54% in 2015. How do you think the UK’s attractiveness for FDI will evolve over the next three years? 36% 29% 56% 47% 59% 65% 54% 54% 30% 44% 32% 37% 32% 35% 39% 30% 34% 9% 9% 7% 4% 8% 5% 16% 2010 2011 2012 2013 2014 2015 March October 2016 2016 Improve Stay the same Decrease Source: EY’s UK attractiveness survey 2012–2016. European investors are the most pessimistic on the UK’s • Flexible labor markets and a large, diverse, creative skills investment attractiveness outlook. Overall, 43% expect a decline pool, with low payroll taxes helping the UK present itself as a and only 23% an improvement. competitive location • Outstanding science, research and technology capacity, although Minimizing any damage to the UK’s growth potential will require Brexit partly puts this at risk since one in four UK academic special care. The complex links between the UK and the EU, 12 research publications arise from a European partnership which have matured over 40 years, may complicate efforts by UK • Tax competitiveness, with the promise of a corporate income tax policymakers to change course. Post Brexit, we believe the UK will 13 (CIT) cut from 20% now to 17% pursue a vigorous blend of free trade policies backed by targeted • London, one of the world’s truly global cities with a interventions. unique combination of language, low taxes, lifestyle, tech skills — although many of these are imported — and tech-savvy The UK’s attractiveness will be underpinned by long-standing consumers, which appeals strongly to Californian technology strengths: companies • Good governance, light regulation, strong financial markets and business support ecosystems 12 “EUA Brexit Factsheet: UK — European Research Collaboration and Student Mobility,” European 13 “Brexit: George Osborne pledges to cut corporation tax,” BBC website, http://www.bbc.com/news/ University Association website, http://www.eua.be/Libraries/publications-homepage-list/ business-36699642, accessed 20 December 2016. eua-brexit-factsheet-research-collaboration-and-student-mobility, accessed 8 December 2016. www.ft.com/content/f4b1cd0a-bd68-11e6-8b45-b8b81dd5d080, accessed 19 December 2016. 14 EY’s European attractiveness survey January 2017

ey.com/attractiveness Companies are taking notice. Since the Brexit referendum, education, skills and talent may be constrained by restrictions on Alphabet has committed to a new headquarters at Kings Cross immigration and by the perception that the UK is less welcoming 14 to foreigners. More than 200,000 students from other European that will house 7,000 workers, up from 4,000 UK staff today. 15 countries study in the UK, 28% of all European mobile students, Apple committed to a new office for 1,400 and more in Battersea. Facebook and Amazon are also expanding in London, where and far ahead of Germany (17%), Austria (8%) and France (7%).17 Europe’s premier digital start-up cluster and ecosystem has sprung However, Cambridge University has reported that the number 16 up in the district of Shoreditch. of applications it has received from prospective EU students have dropped by 14% since the referendum. And the University’s However, some of the same strengths that underpin the UK’s vice-chancellors have warned that immigration restrictions could 18 attractiveness are more threatened by Brexit. For example, have “serious repercussions” for UK research. EY point of view An attractive future Our 2016 UK attractiveness survey, published in May 2016, confirmed areas for trade, which should form the basis for an integrated UK another strong year attracting FDI to the UK. It did, however, also attractiveness strategy: identify increased investor nervousness about the UK’s future 1. Developing a comprehensive approach to skills attractiveness, mainly concerning potential changes to its trade relationship with the EU. 2. Delivering improved infrastructure In response, we’ve updated our investor perceptions survey to compare 3. Signing trade deals to preserve and grow the UK’s market access the mood now with that before the referendum. The results of this, 4. Introducing incentives to encourage investment together with a detailed analysis of FDI in Europe over the last decade, provide the basis for our updated UK attractiveness report. 5. The creation of a digital platform The results are mixed. On the plus side, there is no sign of any All these initiatives should be developed at both national and city or region deterioration in investment intentions over the next 12 months. In fact, levels to ensure trade continues to support UK economic performance and there has been an improvement in short-term sentiment since our last that the benefits of FDI are felt across the whole economy. survey. This integrated strategy must be communicated to investors as soon as However, the medium-term outlook has worsened across a number of possible, with a focus on making certain they are aware of the UK’s vision metrics and investors are concerned about how the UK’s attractiveness for the economy beyond 2019. will develop over the next three years. The respite offered by the stable The current environment is challenging, but there are opportunities as immediate outlook offers the UK Government the chance to implement well as threats. The UK has the chance to move decisively and to position policies that will maintain and grow the UK’s longer-term attractiveness. itself for an attractive future. A sector strategy is essential for shaping the UK’s approach to FDI, and to trade more generally. Once sector priorities have been identified, Mark Gregory our discussions with investors indicate that there are five priority action Chief Economist, EY UK & Ireland 14 “Google commits to £1bn UK investment plan,” BBC website, http://www.bbc.com/news/ business-37988095, accessed 20 December 2016. 15 “Apple moves UK HQ to Battersea power station boiler room in London,” The Guardian website, 17 “EUA Brexit Factsheet: UK — European Research Collaboration and Student Mobility,” European https://www.theguardian.com/uk-news/2016/sep/28/apple-moves-british-hq-into-battersea-power- University Association website, http://www.eua.be/Libraries/publications-homepage-list/ station-boiler-room, accessed 19 December 2016. eua-brexit-factsheet-research-collaboration-and-student-mobility, accessed 8 December 2016. 16 “Facebook ‘likes’ Britain’s talent, to add jobs despite Brexit,” Reuters website, http://www.reuters. 18 “Cambridge warns of Brexit hit on EU student numbers,” Financial Times website, https:// www. com/article/us-facebook-britain-idUSKBN13G0VV, accessed 19 December 2016. ft.com/content/f4b1cd0a-bd68-11e6-8b45-b8b81dd5d080, accessed 19 December 2016. EY’s European attractiveness survey January 2017 15

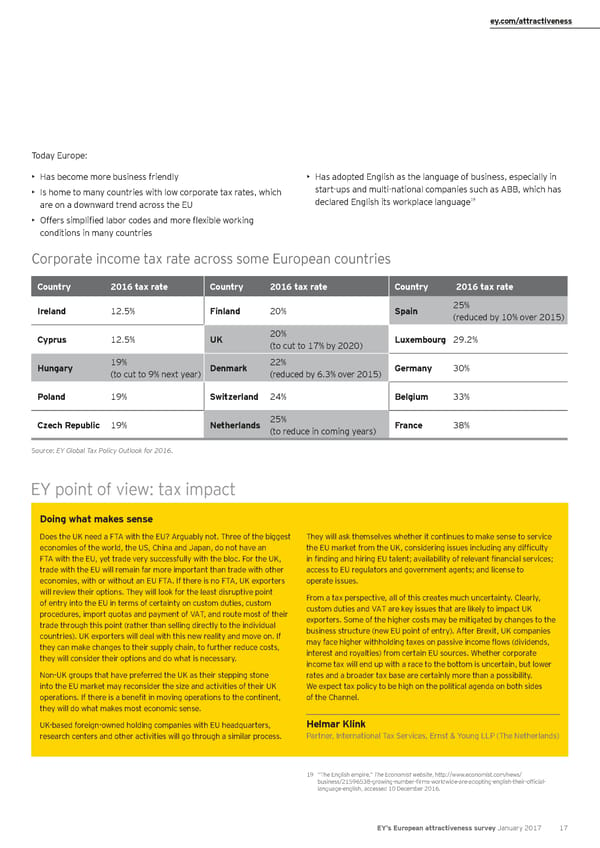

A rethink of pan-European investments and activities is looming The lines of Europe’s FDI map are starting to shift Heightened geographic and political risks across Europe and the Conducted after the referendum, our UK Attractiveness Survey UK are prompting 1 in 10 companies present in Europe to review Autumn 2016 gives some indication of where companies might their business location strategies. Across the continent, Brexit relocate operations from the UK. is having a ripple effect, both cutting across and combining with more local currents. Where will companies want to be in 2019? Which are the top three countries for FDI in Europe? (first choice) % % 27% 22% 1 2 Netherlands UK 38% 40% % % 5 4 Ireland Germany % % 7 8 Spring 2016 France Autumn 2016 Source: EY’s UK attractiveness survey 2016, Autumn 2016. When we surveyed companies for this post-Brexit update to active in the UK (chosen by only 8%), but much more strongly our European attractiveness survey, we found similar thinking. among those not present in the UK (chosen by 44%). A second Only 10% of our respondents gave answers to this question, so cluster of countries in Central and Eastern Europe was also the findings are only indicative. But the choices revealed by the favored by UK companies looking for alternative locations: the 27 responses are broadly in line with trends captured by other Czech Republic was favored by 12%, and Hungary and Poland EY studies. by 11% each. These countries combine affordable labor with Germany was the preferred destination for operations moving from steadily improving skills, investor-friendly policies and increasingly the UK (selected by 54% of respondents who gave an answer), sophisticated business ecosystems. followed by the Netherlands (33%), with France, Italy and Spain When companies investigate alternative locations, the business among the bigger economies in a distant third place with 8% each. environment they find may differ from what they previously Proximity, language skills, attractive employment, and tax laws and expected, because some European countries have adopted historical ties may explain the strong showing of the Netherlands. elements of UK strategies — and are closing the attractiveness gap. France scored low as a potential location for companies currently 16 EY’s European attractiveness survey January 2017

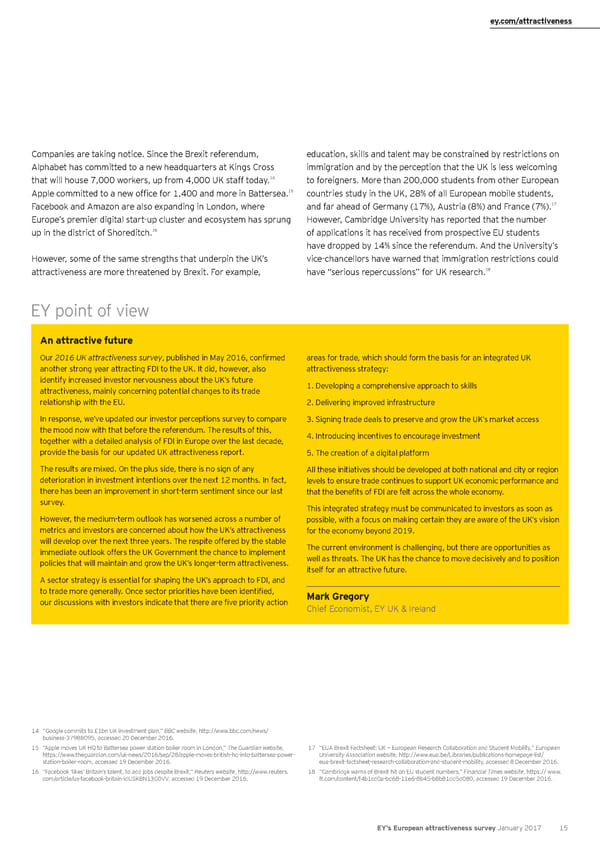

ey.com/attractiveness Today Europe: • Has become more business friendly • Has adopted English as the language of business, especially in • Is home to many countries with low corporate tax rates, which start-ups and multi-national companies such as ABB, which has 19 are on a downward trend across the EU declared English its workplace language • Offers simplified labor codes and more flexible working conditions in many countries Corporate income tax rate across some European countries Country 2016 tax rate Country 2016 tax rate Country 2016 tax rate Ireland 12.5% Finland 20% Spain 25% (reduced by 10% over 2015) Cyprus 12.5% UK 20% Luxembourg 29.2% (to cut to 17% by 2020) Hungary 19% Denmark 22% Germany 30% (to cut to 9% next year) (reduced by 6.3% over 2015) Poland 19% Switzerland 24% Belgium 33% Czech Republic 19% Netherlands 25% France 38% (to reduce in coming years) Source: EY Global Tax Policy Outlook for 2016. EY point of view: tax impact Doing what makes sense Does the UK need a FTA with the EU? Arguably not. Three of the biggest They will ask themselves whether it continues to make sense to service economies of the world, the US, China and Japan, do not have an the EU market from the UK, considering issues including any difficulty FTA with the EU, yet trade very successfully with the bloc. For the UK, in finding and hiring EU talent; availability of relevant financial services; trade with the EU will remain far more important than trade with other access to EU regulators and government agents; and license to economies, with or without an EU FTA. If there is no FTA, UK exporters operate issues. will review their options. They will look for the least disruptive point From a tax perspective, all of this creates much uncertainty. Clearly, of entry into the EU in terms of certainty on custom duties, custom custom duties and VAT are key issues that are likely to impact UK procedures, import quotas and payment of VAT, and route most of their exporters. Some of the higher costs may be mitigated by changes to the trade through this point (rather than selling directly to the individual business structure (new EU point of entry). After Brexit, UK companies countries). UK exporters will deal with this new reality and move on. If may face higher withholding taxes on passive income flows (dividends, they can make changes to their supply chain, to further reduce costs, interest and royalties) from certain EU sources. Whether corporate they will consider their options and do what is necessary. income tax will end up with a race to the bottom is uncertain, but lower Non-UK groups that have preferred the UK as their stepping stone rates and a broader tax base are certainly more than a possibility. into the EU market may reconsider the size and activities of their UK We expect tax policy to be high on the political agenda on both sides operations. If there is a benefit in moving operations to the continent, of the Channel. they will do what makes most economic sense. UK-based foreign-owned holding companies with EU headquarters, Helmar Klink research centers and other activities will go through a similar process. Partner, International Tax Services, Ernst & Young LLP (The Netherlands) 19 “The English empire,” The Economist website, http://www.economist.com/news/ business/21596538-growing-number-firms-worldwide-are-adopting-english-their-official- language-english, accessed 10 December 2016. EY’s European attractiveness survey January 2017 17

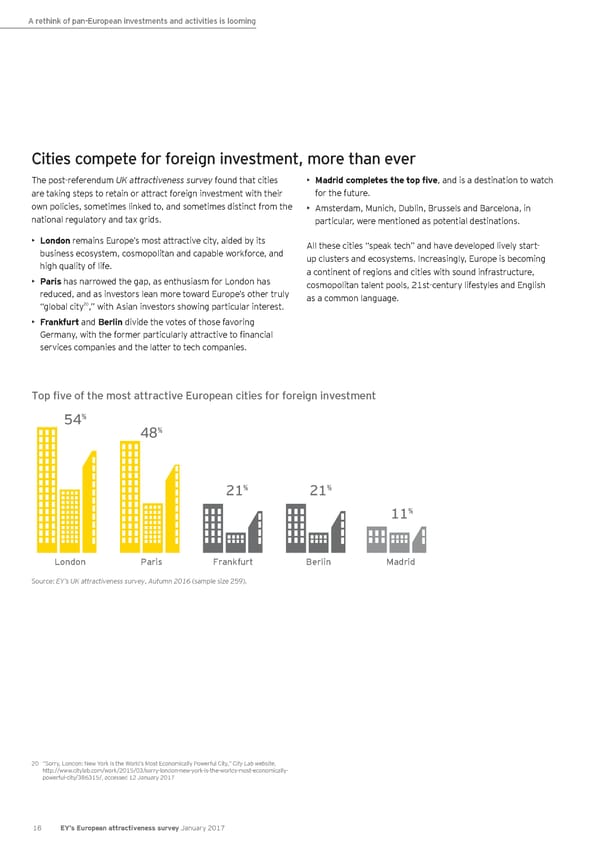

A rethink of pan-European investments and activities is looming Cities compete for foreign investment, more than ever The post-referendum UK attractiveness survey found that cities • Madrid completes the top five, and is a destination to watch are taking steps to retain or attract foreign investment with their for the future. own policies, sometimes linked to, and sometimes distinct from the • Amsterdam, Munich, Dublin, Brussels and Barcelona, in national regulatory and tax grids. particular, were mentioned as potential destinations. • London remains Europe’s most attractive city, aided by its All these cities “speak tech” and have developed lively start- business ecosystem, cosmopolitan and capable workforce, and up clusters and ecosystems. Increasingly, Europe is becoming high quality of life. a continent of regions and cities with sound infrastructure, • Paris has narrowed the gap, as enthusiasm for London has cosmopolitan talent pools, 21st-century lifestyles and English reduced, and as investors lean more toward Europe’s other truly as a common language. 20 “global city ,” with Asian investors showing particular interest. • Frankfurt and Berlin divide the votes of those favoring Germany, with the former particularly attractive to financial services companies and the latter to tech companies. Top five of the most attractive European cities for foreign investment 54% 48% 21% 21% 11% London Paris Frankfurt Berlin Madrid Source: EY’s UK attractiveness survey, Autumn 2016 (sample size 259). 20 “Sorry, London: New York Is the World’s Most Economically Powerful City,” City Lab website, http://www.citylab.com/work/2015/03/sorry-london-new-york-is-the-worlds-most-economically- powerful-city/386315/, accessed 12 January 2017 18 EY’s European attractiveness survey January 2017

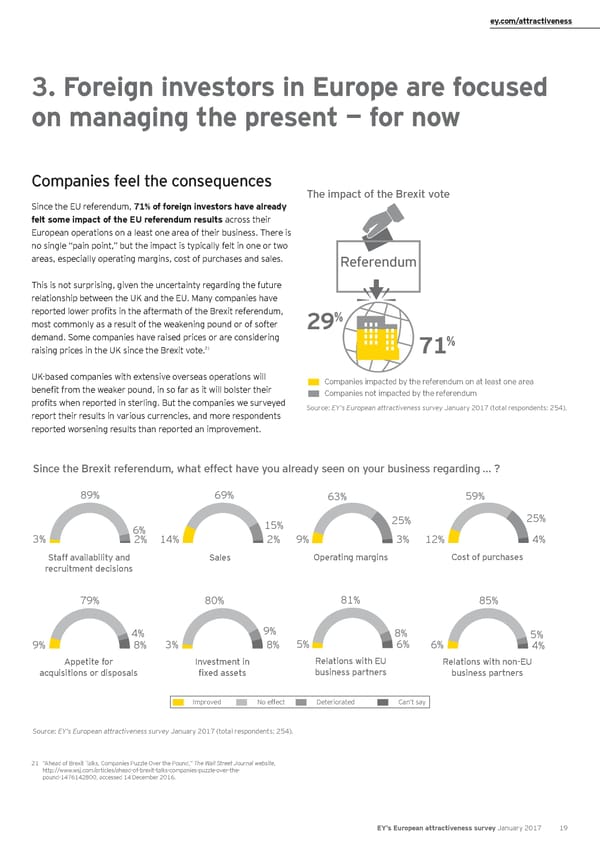

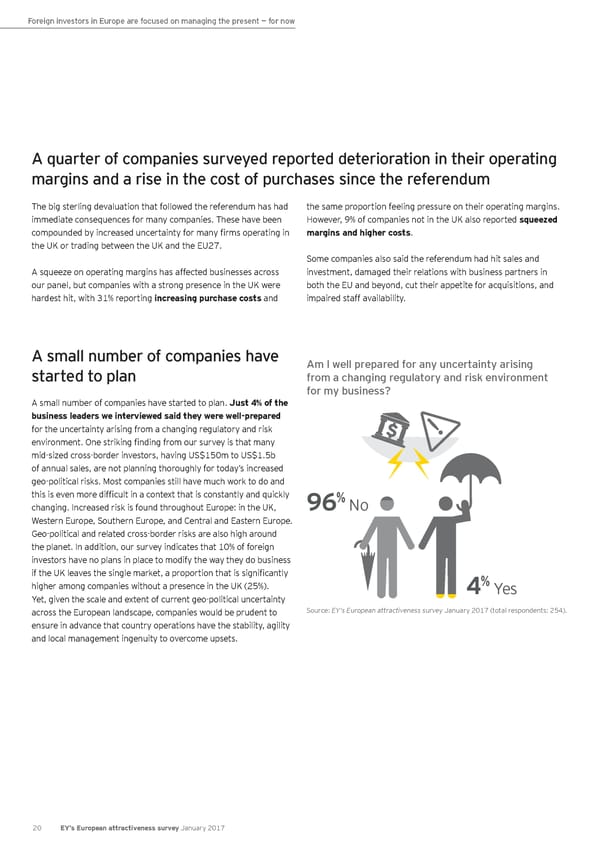

ey.com/attractiveness 3. Foreign investors in Europe are focused on managing the present — for now Companies feel the consequences The impact of the Brexit vote Since the EU referendum, 71% of foreign investors have already felt some impact of the EU referendum results across their European operations on a least one area of their business. There is no single “pain point,” but the impact is typically felt in one or two areas, especially operating margins, cost of purchases and sales. Referendum This is not surprising, given the uncertainty regarding the future relationship between the UK and the EU. Many companies have reported lower profits in the aftermath of the Brexit referendum, % most commonly as a result of the weakening pound or of softer 29 demand. Some companies have raised prices or are considering % 21 71 raising prices in the UK since the Brexit vote. UK-based companies with extensive overseas operations will Companies impacted by the referendum on at least one area benefit from the weaker pound, in so far as it will bolster their Companies not impacted by the referendum profits when reported in sterling. But the companies we surveyed Source: EY’s European attractiveness survey January 2017 (total respondents: 254). report their results in various currencies, and more respondents reported worsening results than reported an improvement. Since the Brexit referendum, what effect have you already seen on your business regarding … ? 89% 69% 63% 59% 15% 25% 25% 3% 6% 12% 4% 2% 14% 2% 9% 3% Staff availability and Sales Operating margins Cost of purchases recruitment decisions 79% 80% 81% 85% 4% 9% 8% 5% 9% 8% 3% 8% 5% 6% 6% 4% Appetite for Investment in Relations with EU Relations with non-EU acquisitions or disposals fixed assets business partners business partners Improved No effect Deteriorated Can’t say Source: EY’s European attractiveness survey January 2017 (total respondents: 254). 21 “Ahead of Brexit Talks, Companies Puzzle Over the Pound,” The Wall Street Journal website, http://www.wsj.com/articles/ahead-of-brexit-talks-companies-puzzle-over-the- pound-1476142800, accessed 14 December 2016. EY’s European attractiveness survey January 2017 19

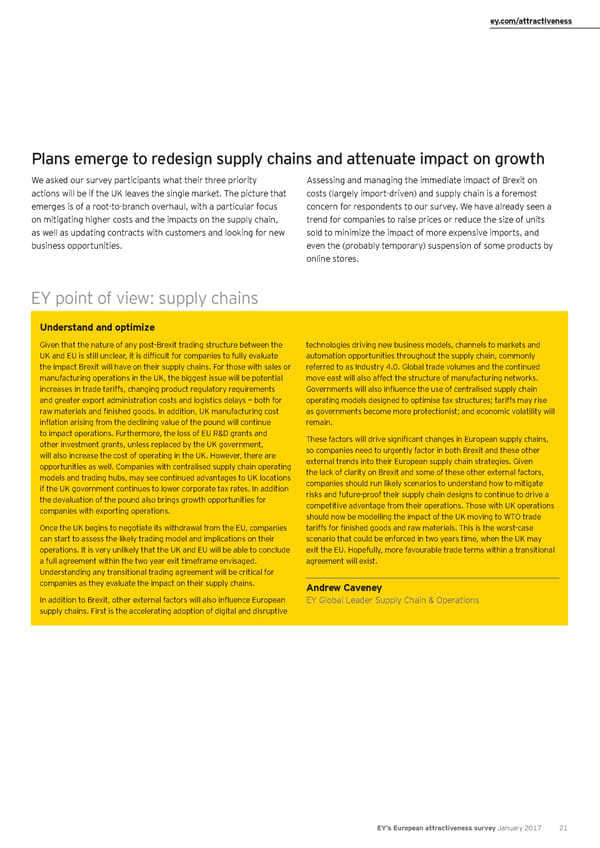

Foreign investors in Europe are focused on managing the present — for now A quarter of companies surveyed reported deterioration in their operating margins and a rise in the cost of purchases since the referendum The big sterling devaluation that followed the referendum has had the same proportion feeling pressure on their operating margins. immediate consequences for many companies. These have been However, 9% of companies not in the UK also reported squeezed compounded by increased uncertainty for many firms operating in margins and higher costs. the UK or trading between the UK and the EU27. Some companies also said the referendum had hit sales and A squeeze on operating margins has affected businesses across investment, damaged their relations with business partners in our panel, but companies with a strong presence in the UK were both the EU and beyond, cut their appetite for acquisitions, and hardest hit, with 31% reporting increasing purchase costs and impaired staff availability. A small number of companies have Am I well prepared for any uncertainty arising started to plan from a changing regulatory and risk environment for my business? A small number of companies have started to plan. Just 4% of the business leaders we interviewed said they were well-prepared for the uncertainty arising from a changing regulatory and risk environment. One striking finding from our survey is that many mid-sized cross-border investors, having US$150m to US$1.5b of annual sales, are not planning thoroughly for today’s increased geo-political risks. Most companies still have much work to do and this is even more difficult in a context that is constantly and quickly % changing. Increased risk is found throughout Europe: in the UK, 96 No Western Europe, Southern Europe, and Central and Eastern Europe. Geo-political and related cross-border risks are also high around the planet. In addition, our survey indicates that 10% of foreign investors have no plans in place to modify the way they do business if the UK leaves the single market, a proportion that is significantly % higher among companies without a presence in the UK (25%). 4 Yes Yet, given the scale and extent of current geo-political uncertainty across the European landscape, companies would be prudent to Source: EY’s European attractiveness survey January 2017 (total respondents: 254). ensure in advance that country operations have the stability, agility and local management ingenuity to overcome upsets. 20 EY’s European attractiveness survey January 2017

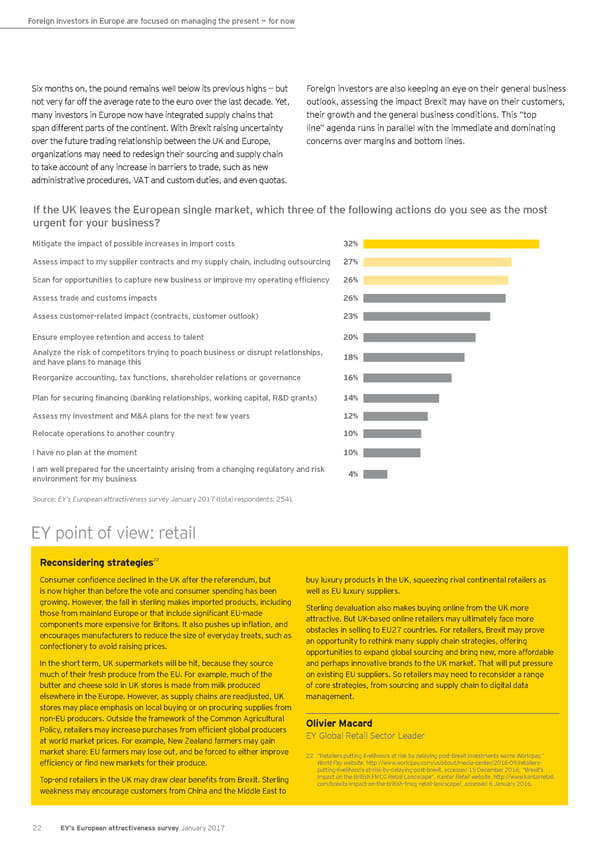

ey.com/attractiveness Plans emerge to redesign supply chains and attenuate impact on growth We asked our survey participants what their three priority Assessing and managing the immediate impact of Brexit on actions will be if the UK leaves the single market. The picture that costs (largely import-driven) and supply chain is a foremost emerges is of a root-to-branch overhaul, with a particular focus concern for respondents to our survey. We have already seen a on mitigating higher costs and the impacts on the supply chain, trend for companies to raise prices or reduce the size of units as well as updating contracts with customers and looking for new sold to minimize the impact of more expensive imports, and business opportunities. even the (probably temporary) suspension of some products by online stores. EY point of view: supply chains Understand and optimize Given that the nature of any post-Brexit trading structure between the technologies driving new business models, channels to markets and UK and EU is still unclear, it is difficult for companies to fully evaluate automation opportunities throughout the supply chain, commonly the impact Brexit will have on their supply chains. For those with sales or referred to as Industry 4.0. Global trade volumes and the continued manufacturing operations in the UK, the biggest issue will be potential move east will also affect the structure of manufacturing networks. increases in trade tariffs, changing product regulatory requirements Governments will also influence the use of centralised supply chain and greater export administration costs and logistics delays — both for operating models designed to optimise tax structures; tariffs may rise raw materials and finished goods. In addition, UK manufacturing cost as governments become more protectionist; and economic volatility will inflation arising from the declining value of the pound will continue remain. to impact operations. Furthermore, the loss of EU R&D grants and These factors will drive significant changes in European supply chains, other investment grants, unless replaced by the UK government, so companies need to urgently factor in both Brexit and these other will also increase the cost of operating in the UK. However, there are external trends into their European supply chain strategies. Given opportunities as well. Companies with centralised supply chain operating the lack of clarity on Brexit and some of these other external factors, models and trading hubs, may see continued advantages to UK locations companies should run likely scenarios to understand how to mitigate if the UK government continues to lower corporate tax rates. In addition risks and future-proof their supply chain designs to continue to drive a the devaluation of the pound also brings growth opportunities for competitive advantage from their operations. Those with UK operations companies with exporting operations. should now be modelling the impact of the UK moving to WTO trade Once the UK begins to negotiate its withdrawal from the EU, companies tariffs for finished goods and raw materials. This is the worst-case can start to assess the likely trading model and implications on their scenario that could be enforced in two years time, when the UK may operations. It is very unlikely that the UK and EU will be able to conclude exit the EU. Hopefully, more favourable trade terms within a transitional a full agreement within the two year exit timeframe envisaged. agreement will exist. Understanding any transitional trading agreement will be critical for companies as they evaluate the impact on their supply chains. Andrew Caveney In addition to Brexit, other external factors will also influence European EY Global Leader Supply Chain & Operations supply chains. First is the accelerating adoption of digital and disruptive EY’s European attractiveness survey January 2017 21

Foreign investors in Europe are focused on managing the present — for now Six months on, the pound remains well below its previous highs — but Foreign investors are also keeping an eye on their general business not very far off the average rate to the euro over the last decade. Yet, outlook, assessing the impact Brexit may have on their customers, many investors in Europe now have integrated supply chains that their growth and the general business conditions. This “top span different parts of the continent. With Brexit raising uncertainty line” agenda runs in parallel with the immediate and dominating over the future trading relationship between the UK and Europe, concerns over margins and bottom lines. organizations may need to redesign their sourcing and supply chain to take account of any increase in barriers to trade, such as new administrative procedures, VAT and custom duties, and even quotas. If the UK leaves the European single market, which three of the following actions do you see as the most urgent for your business? Mitigate the impact of possible increases in import costs 32% Assess impact to my supplier contracts and my supply chain, including outsourcing 27% Scan for opportunities to capture new business or improve my operating efficiency 26% Assess trade and customs impacts 26% Assess customer-related impact (contracts, customer outlook) 23% Ensure employee retention and access to talent 20% Analyze the risk of competitors trying to poach business or disrupt relationships, 18% and have plans to manage this Reorganize accounting, tax functions, shareholder relations or governance 16% Plan for securing financing (banking relationships, working capital, R&D grants) 14% Assess my investment and M&A plans for the next few years 12% Relocate operations to another country 10% I have no plan at the moment 10% I am well prepared for the uncertainty arising from a changing regulatory and risk 4% environment for my business Source: EY’s European attractiveness survey January 2017 (total respondents: 254). EY point of view: retail Reconsidering strategies22 Consumer confidence declined in the UK after the referendum, but buy luxury products in the UK, squeezing rival continental retailers as is now higher than before the vote and consumer spending has been well as EU luxury suppliers. growing. However, the fall in sterling makes imported products, including Sterling devaluation also makes buying online from the UK more those from mainland Europe or that include significant EU-made attractive. But UK-based online retailers may ultimately face more components more expensive for Britons. It also pushes up inflation, and obstacles in selling to EU27 countries. For retailers, Brexit may prove encourages manufacturers to reduce the size of everyday treats, such as an opportunity to rethink many supply chain strategies, offering confectionery to avoid raising prices. opportunities to expand global sourcing and bring new, more affordable In the short term, UK supermarkets will be hit, because they source and perhaps innovative brands to the UK market. That will put pressure much of their fresh produce from the EU. For example, much of the on existing EU suppliers. So retailers may need to reconsider a range butter and cheese sold in UK stores is made from milk produced of core strategies, from sourcing and supply chain to digital data elsewhere in the Europe. However, as supply chains are readjusted, UK management. stores may place emphasis on local buying or on procuring supplies from non-EU producers. Outside the framework of the Common Agricultural Olivier Macard Policy, retailers may increase purchases from efficient global producers EY Global Retail Sector Leader at world market prices. For example, New Zealand farmers may gain market share: EU farmers may lose out, and be forced to either improve 22 “Retailers putting livelihoods at risk by delaying post-Brexit investments warns Worldpay,” efficiency or find new markets for their produce. World Pay website, http://www.worldpay.com/us/about/media-center/2016-09/retailers- putting-livelihoods-at-risk-by-delaying-post-brexit, accessed 15 December 2016; “Brexit’s Top-end retailers in the UK may draw clear benefits from Brexit. Sterling Impact on the British FMCG Retail Landscape”, Kantar Retail website, http://www.kantarretail. weakness may encourage customers from China and the Middle East to com/brexits-impact-on-the-british-fmcg-retail-landscape/, accessed 6 January 2016. 22 EY’s European attractiveness survey January 2017

ey.com/attractiveness EY point of view: trade and supply chain Understanding the trade-offs From a trade and supply chain standpoint, the vote in favor of Brexit In case of the Netherlands and Belgium, both are major trade hubs with involves potential changes for European businesses. a high degree of exposure to the UK market. For Ireland, the UK is an Currently, as part of the EU, the UK enjoys unfettered access to the important export destination. bloc’s single market without tariffs or quotas, and vice versa for EU For European boardrooms, Brexit raises question not just over the countries. The EU is a large trade partner for the UK, accounting for 44% future UK-EU trade relationship but also those with other trade partners. of exports and 53% of imports in 2015. The central scenario remains Following Brexit, the UK will lose its preferential trade relationships with that the UK and EU strikes a Free Trade Agreement of some sort, which over 50 countries with which the EU currently has FTAs, though it will would involve no or limited tariffs. However, if the UK leaves the single almost certainly seek to grandfather many of these. Britain leaving could market without a trade deal with the EU, trade between the UK and the also trigger calls for compensatory measures from countries with whom EU would be subject to average most favored nation tariffs applied by the EU currently has FTAs with, given that the EU market will shrink. the EU on other WTO members. These range from: cars 9.8%, chemicals However, the UK will also be able to run its own trade policy, which offers 4.5%, textiles 6.5%, beverages and tobacco 19.4% and transport the chance to strike quicker FTAs with countries such as the US, New equipment 4.3%. Even with an FTA, exporters and importers would still Zealand, Australia and emerging economies. This could open up new be subject to new rules and customs procedures, such as rules of origin. markets for UK-based businesses. From an EU perspective, the UK is an important part of the European supply chain, both for manufacturing goods and services such as finance Mats Persson and media. The Netherlands, Ireland, Belgium, Germany and France are EY Executive Director, Performance Improvement likely to be most impacted in trade terms by a UK departure from the EU. Source: “Beyond Britain: The global implications of Brexit,” HSBC Global Research, 24 June 2016, via Thomson Research; Brexit: What does it mean for Europe?, Euler Hermes, May 2016; Economic Analysis — Brexit: Export Opportunities, Not Just Risks, BMI Research, 18 July 2016; Brexportgeddon?, Oxford Economics, March 2016; World Tariff Profiles 2016, World Trade Organization, 2016. EY’s European attractiveness survey January 2017 23

4. A longer-term agenda for businesses and governments in Europe 1Managing investment decisions in an increasingly volatile environment Investors in Europe are confronted by many uncertainties. Overall, for unexpected events, such as Brexit. On the regulatory and tax front, 37% of respondents to our survey are concerned about capital market an ability to monitor changing policies and assess their economic and volatility and its impact on FDI, while 32% consider economic and fiscal impact will be essential. political instability in the EU a key risk. For them, Brexit is one of many Issues for governments: Brexit is yet another challenge for EU tectonic changes affecting Europe. Only 4% of respondents say they institutions and for European governments, which are already are well-prepared for the changing risk and regulatory environment searching for better responses to weak growth, inequality and fiscal (including tax). imbalances. Governments should look to engage with business leaders Issues for businesses: An uncertain business environment remains to develop new policies that better balance corporate and public the top concern for investors — whether that relates to currency or interests. But the Brexit decision throws up opportunities too. With 1 geopolitical risks. Businesses need to consider how to remain agile for in 10 of our respondents now looking to relocate some part of their this “new normal” of increased volatility and uncertainty. Investing in operations, some national regulatory authorities and city leaders are scenario-based approaches to planning can help businesses prepare working with business to highlight attractions of alternative locations. Preparing for creeping protectionism and an uncertain trade 2environment The vote in favor of Brexit has unleashed a wave of uncertainty costs, at the least because of changing import procedures. Businesses regarding the UK’s future trade policies and trading arrangements (especially those with operations in the UK) must be prepared to review with the EU. Coupled with an increase in protectionist sentiment, and even redesign their sourcing and supply chain strategies. this uncertainty puts trade back on the agenda for European boards. Issues for governments: Policymakers need to build a more Already, 32% of respondents to our survey are focusing on mitigating inclusive, fairer trade system and must counter any negative effects higher import costs, and 27% consider assessing impacts on supply of protectionist and nationalist sentiment in Europe. They also need to chains as a priority. respond to the demand of businesses for more clarity on future trade Issues for businesses: In the short run, organizations may consider policy. The EU must continue to improve the functioning of the single revising supply chains to manage currency fluctuations. Post Brexit, market and must speed up the completion of free trade deals. companies trading between the UK and EU27 are likely to face higher 3Navigating Europe’s redrawn attractiveness map Foreign investors remain rather upbeat about Europe’s attractiveness: Issues for governments: A changing European FDI landscape 56% plan to grow their presence in Europe by 2019. But there’s may prompt some countries to think more deeply about national no room for complacency. The continent has lost one of its biggest attractiveness factors (such as talent or innovation) as well as policies advantages in the global FDI landscape — the draw of a stable, that affect inward investment (including business regulation). At the predictable investment environment. With 1 in 10 respondents to our same time, policymakers in Europe would be well advised to reiterate survey already planning to relocate operations, Europe’s FDI map is the enduring nature of the continent’s attractiveness features and to about to be redrawn. take corrective action when and where needed. Issues for businesses: With change in Europe’s investment attractiveness map looming, businesses need to assess both apparent and less visible costs, and to consider how they are likely to change in the future. Sound market intelligence and a fact-based, granular approach, balancing short-term pressures and long-term critical success factors (such as turnover, productivity, production or infrastructure bottlenecks, skill shortages and resources) will be vital. 24 EY’s European attractiveness survey January 2017

ey.com/attractiveness 4Tackling the talent conundrum Brexit has brought the issue of free movement of labor across Europe may need to increase their use of automation and digitization and to the fore. This will change the parameters of competition for talent, cross-border virtual teams. and could intensify rivalry to attract the best people in some places. Issues for governments: Some European countries may need to Already, about 20% of respondents consider employee retention and revise their employment legislation to make the hiring of people access to talent as priorities if the UK leaves the European single simpler, more affordable and more predictable for employers, and market. to enhance their national capacity to access and attract high-quality Issues for businesses: There is an increasingly intense race between talent. This may require a re-examination of procedures for expatriate companies for skills and talent, which is likely to make labor more workers and students, in particular. Policymakers need to invest in expensive. Businesses may need to redesign their people strategies, education, training and R&D capacity to enhance skills in the existing and to rethink their operations and location strategies. And to talent pool. overcome any restrictions on the free movement of labor, businesses 5Bridging the finance and innovation gaps Perceptions of Europe’s capacity for fostering innovation and funding ecosystem. Some European countries have strong national entrepreneurship are improving according to EY’s most recent bodies that offer funding, sometimes in exchange for equity, and European attractiveness surveys. But foreign investors measure EU resources underpin some venture lending. Thinking ahead and European performance against able and improving competition from choosing a location which offers the best funding options within an the US and Asia. appropriate ecosystem should be front-of-mind for innovation-driven Issues for businesses: The UK is the most productive country in investors. Europe in terms of scientific output, and one in four UK publications Issues for governments: The UK Government has shown it is alert is done in collaboration with a European partner. Twenty percent of to possible funding challenges arising from Brexit, and has pledged to projects under the EU’s Horizon 2020 program are coordinated by UK make good any shortfalls. More widely, access to finance is one of the institutions. These provide valuable ideas and resources for business, main challenges for companies in Europe, in particular those that are and the UK Government has pledged to replace EU funding and ensure smaller, younger and more innovative. Studies show that total SME these fruitful partnerships continue. financing gaps for European countries are three to five times bigger However, international investors and entrepreneurs need to look than the gap in the US. At the same time, innovative companies face carefully at present and future funding availability when choosing more limited access to business angel capital and venture capital than where to locate innovation-led businesses, whether these are start- their US counterparts. Policymakers everywhere in Europe should ups or new international operations. Tech start-ups typically rely upon focus more on services, on people and on places. EU and national a mix of founder funding, angel investors, venture capital and state efforts to improve innovation and its financing must be sustained and lending which evolves as they mature. The UK has a well-developed developed further, and any negative consequences arising from a Brexit must be addressed. EY’s European attractiveness survey January 2017 25