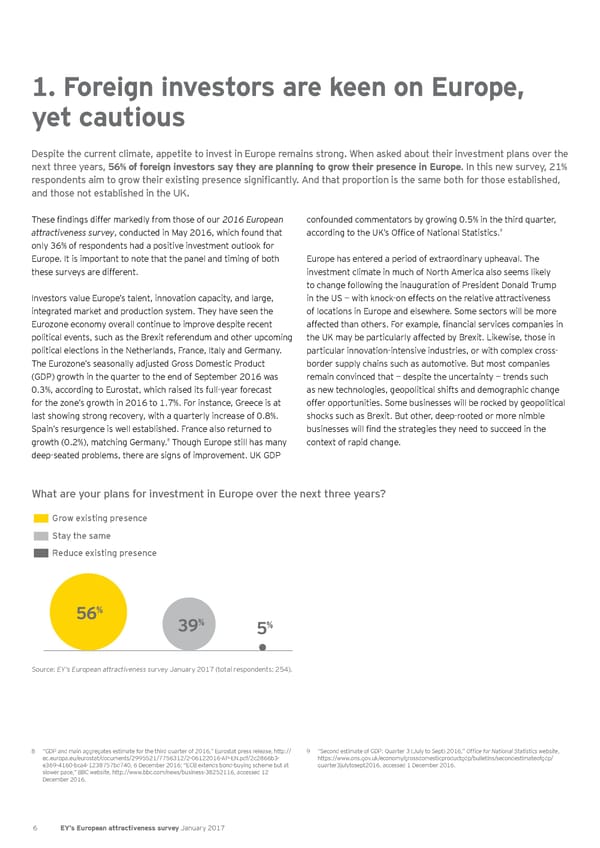

1. Foreign investors are keen on Europe, yet cautious Despite the current climate, appetite to invest in Europe remains strong. When asked about their investment plans over the next three years, 56% of foreign investors say they are planning to grow their presence in Europe. In this new survey, 21% respondents aim to grow their existing presence significantly. And that proportion is the same both for those established, and those not established in the UK. These findings differ markedly from those of our 2016 European confounded commentators by growing 0.5% in the third quarter, 9 attractiveness survey, conducted in May 2016, which found that according to the UK’s Office of National Statistics. only 36% of respondents had a positive investment outlook for Europe. It is important to note that the panel and timing of both Europe has entered a period of extraordinary upheaval. The these surveys are different. investment climate in much of North America also seems likely to change following the inauguration of President Donald Trump Investors value Europe’s talent, innovation capacity, and large, in the US — with knock-on effects on the relative attractiveness integrated market and production system. They have seen the of locations in Europe and elsewhere. Some sectors will be more Eurozone economy overall continue to improve despite recent affected than others. For example, financial services companies in political events, such as the Brexit referendum and other upcoming the UK may be particularly affected by Brexit. Likewise, those in political elections in the Netherlands, France, Italy and Germany. particular innovation-intensive industries, or with complex cross- The Eurozone’s seasonally adjusted Gross Domestic Product border supply chains such as automotive. But most companies (GDP) growth in the quarter to the end of September 2016 was remain convinced that — despite the uncertainty — trends such 0.3%, according to Eurostat, which raised its full-year forecast as new technologies, geopolitical shifts and demographic change for the zone’s growth in 2016 to 1.7%. For instance, Greece is at offer opportunities. Some businesses will be rocked by geopolitical last showing strong recovery, with a quarterly increase of 0.8%. shocks such as Brexit. But other, deep-rooted or more nimble Spain’s resurgence is well established. France also returned to businesses will find the strategies they need to succeed in the growth (0.2%), matching Germany.8 context of rapid change. Though Europe still has many deep-seated problems, there are signs of improvement. UK GDP What are your plans for investment in Europe over the next three years? Grow existing presence Stay the same Reduce existing presence 56% % % 39 5 Source: EY’s European attractiveness survey January 2017 (total respondents: 254). 8 “GDP and main aggregates estimate for the third quarter of 2016,” Eurostat press release, http:// 9 “Second estimate of GDP: Quarter 3 (July to Sept) 2016,” Office for National Statistics website, ec.europa.eu/eurostat/documents/2995521/7756312/2-06122016-AP-EN.pdf/2c2866b3- https://www.ons.gov.uk/economy/grossdomesticproductgdp/bulletins/secondestimateofgdp/ e369-4160-bca4-1238757bd740, 6 December 2016; “ECB extends bond-buying scheme but at quarter3julytosept2016, accessed 1 December 2016. slower pace,” BBC website, http://www.bbc.com/news/business-38252116, accessed 12 December 2016. 6 EY’s European attractiveness survey January 2017

European attractiveness survey January 2017 Page 9 Page 11

European attractiveness survey January 2017 Page 9 Page 11