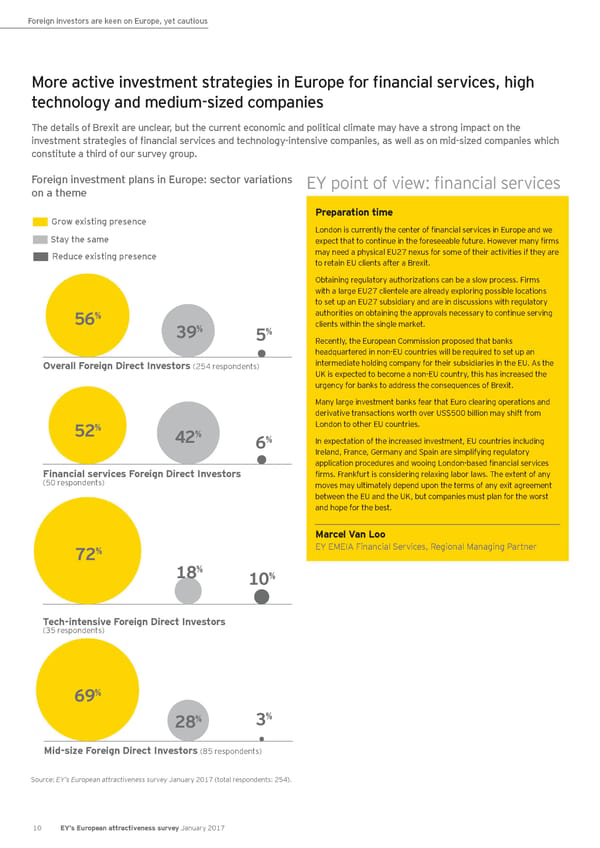

Foreign investors are keen on Europe, yet cautious More active investment strategies in Europe for financial services, high technology and medium-sized companies The details of Brexit are unclear, but the current economic and political climate may have a strong impact on the investment strategies of financial services and technology-intensive companies, as well as on mid-sized companies which constitute a third of our survey group. Foreign investment plans in Europe: sector variations EY point of view: financial services on a theme Preparation time Grow existing presence London is currently the center of financial services in Europe and we Stay the same expect that to continue in the foreseeable future. However many firms Reduce existing presence may need a physical EU27 nexus for some of their activities if they are to retain EU clients after a Brexit. Obtaining regulatory authorizations can be a slow process. Firms with a large EU27 clientele are already exploring possible locations to set up an EU27 subsidiary and are in discussions with regulatory 56% authorities on obtaining the approvals necessary to continue serving % % clients within the single market. 39 5 Recently, the European Commission proposed that banks headquartered in non-EU countries will be required to set up an Overall Foreign Direct Investors (254 respondents) intermediate holding company for their subsidiaries in the EU. As the UK is expected to become a non-EU country, this has increased the urgency for banks to address the consequences of Brexit. Many large investment banks fear that Euro clearing operations and derivative transactions worth over US$500 billion may shift from 52% London to other EU countries. % % 42 6 In expectation of the increased investment, EU countries including Ireland, France, Germany and Spain are simplifying regulatory application procedures and wooing London-based financial services Financial services Foreign Direct Investors firms. Frankfurt is considering relaxing labor laws. The extent of any (50 respondents) moves may ultimately depend upon the terms of any exit agreement between the EU and the UK, but companies must plan for the worst and hope for the best. Marcel Van Loo 72% EY EMEIA Financial Services, Regional Managing Partner % 18 10% Tech-intensive Foreign Direct Investors (35 respondents) 69% % % 28 3 Mid-size Foreign Direct Investors (85 respondents) Source: EY’s European attractiveness survey January 2017 (total respondents: 254). 10 EY’s European attractiveness survey January 2017

European attractiveness survey January 2017 Page 13 Page 15

European attractiveness survey January 2017 Page 13 Page 15