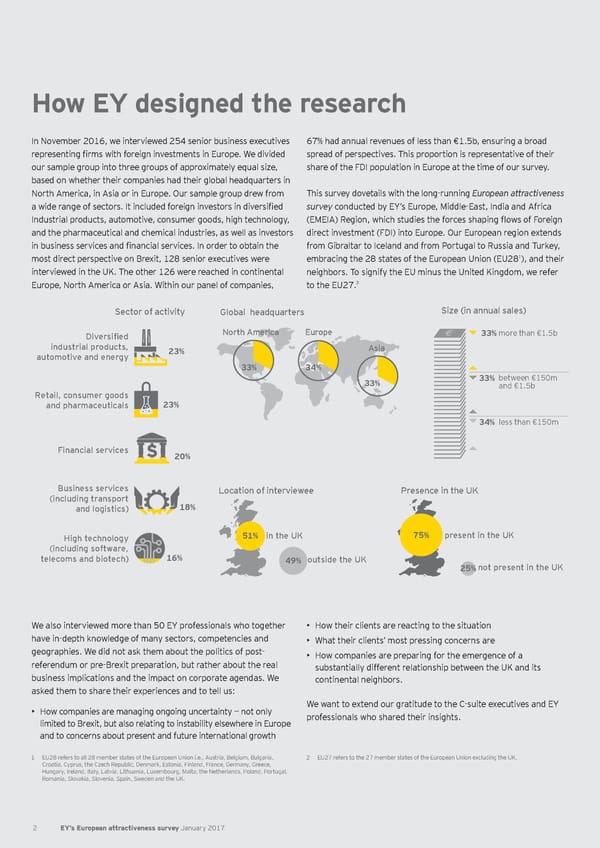

How EY designed the research In November 2016, we interviewed 254 senior business executives 67% had annual revenues of less than €1.5b, ensuring a broad representing firms with foreign investments in Europe. We divided spread of perspectives. This proportion is representative of their our sample group into three groups of approximately equal size, share of the FDI population in Europe at the time of our survey. based on whether their companies had their global headquarters in North America, in Asia or in Europe. Our sample group drew from This survey dovetails with the long-running European attractiveness a wide range of sectors. It included foreign investors in diversified survey conducted by EY’s Europe, Middle-East, India and Africa Industrial products, automotive, consumer goods, high technology, (EMEIA) Region, which studies the forces shaping flows of Foreign and the pharmaceutical and chemical industries, as well as investors direct investment (FDI) into Europe. Our European region extends in business services and financial services. In order to obtain the from Gibraltar to Iceland and from Portugal to Russia and Turkey, 1 most direct perspective on Brexit, 128 senior executives were embracing the 28 states of the European Union (EU28 ), and their interviewed in the UK. The other 126 were reached in continental neighbors. To signify the EU minus the United Kingdom, we refer Europe, North America or Asia. Within our panel of companies, 2 to the EU27. Sector of activity Global headquarters Size (in annual sales) Diversified North America Europe 33%more than €1.5b industrial products, 23% Asia automotive and energy 33% 34% 33% 33% between €150m and €1.5b Retail, consumer goods and pharmaceuticals 23% 34% less than €150m Financial services 20% Business services Location of interviewee Presence in the UK (including transport 18% and logistics) High technology 51% in the UK 75% present in the UK (including software, telecoms and biotech) 16% 49% outside the UK 25%not present in the UK We also interviewed more than 50 EY professionals who together • How their clients are reacting to the situation have in-depth knowledge of many sectors, competencies and • What their clients’ most pressing concerns are geographies. We did not ask them about the politics of post- • How companies are preparing for the emergence of a referendum or pre-Brexit preparation, but rather about the real substantially different relationship between the UK and its business implications and the impact on corporate agendas. We continental neighbors. asked them to share their experiences and to tell us: • How companies are managing ongoing uncertainty — not only We want to extend our gratitude to the C-suite executives and EY limited to Brexit, but also relating to instability elsewhere in Europe professionals who shared their insights. and to concerns about present and future international growth 1 EU28 refers to all 28 member states of the European Union i.e., Austria, Belgium, Bulgaria, 2 EU27 refers to the 27 member states of the European Union excluding the UK. Croatia, Cyprus, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden and the UK. 2 EY’s European attractiveness survey January 2017

European attractiveness survey January 2017 Page 4 Page 6

European attractiveness survey January 2017 Page 4 Page 6