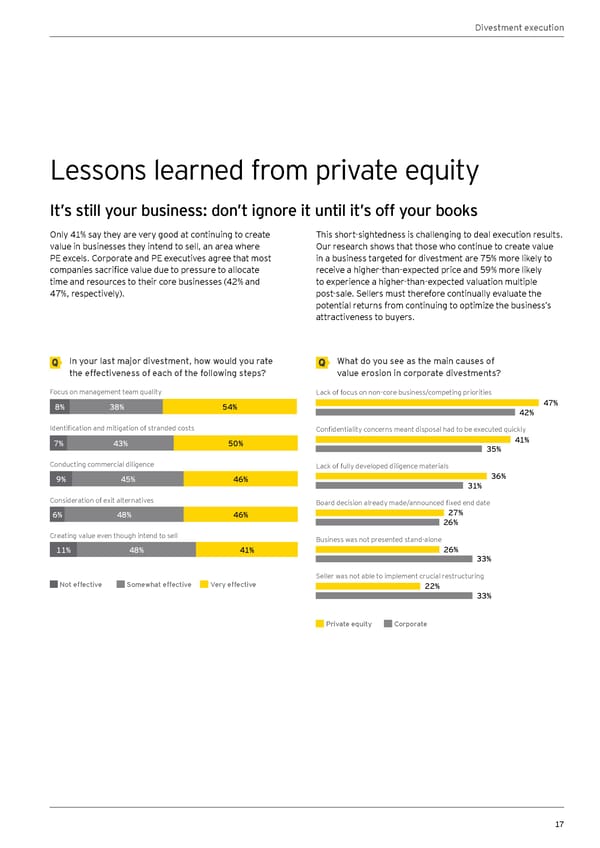

Divestment execution Lessons learned from private equity It’s still your business: don’t ignore it until it’s off your books Only 41% say they are very good at continuing to create This short-sightedness is challenging to deal execution results. value in businesses they intend to sell, an area where Our research shows that those who continue to create value PE excels. Corporate and PE executives agree that most in a business targeted for divestment are 75% more likely to companies sacrifice value due to pressure to allocate receive a higher-than-expected price and 59% more likely time and resources to their core businesses (42% and to experience a higher-than-expected valuation multiple 47%, respectively). post-sale. Sellers must therefore continually evaluate the potential returns from continuing to optimize the business’s attractiveness to buyers. In your last major divestment, how would you rate What do you see as the main causes of the effectiveness of each of the following steps? value erosion in corporate divestments? Focus on management team quality Lack of focus on non-core business/competing priorities 8% 38% 54% 47% 42% Identification and mitigation of stranded costs Confidentiality concerns meant disposal had to be executed quickly 7% 43% 50% 41% 35% Conducting commercial diligence Lack of fully developed diligence materials 9% 45% 46% 36% 31% Consideration of exit alternatives Board decision already made/announced fixed end date 6% 48% 46% 27% 26% Creating value even though intend to sell Business was not presented stand-alone 11% 48% 41% 26% 33% Seller was not able to implement crucial restructuring Not effective Somewhat effective Very effective 22% 33% Private equity Corporate 17

Global Corporate Divestment Study Page 16 Page 18

Global Corporate Divestment Study Page 16 Page 18