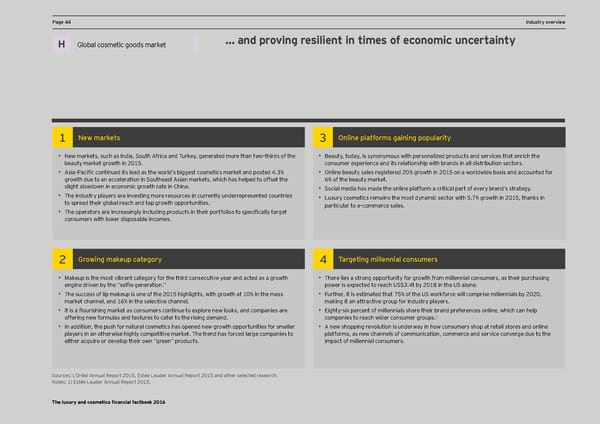

PPage 44age 44 DCF and valuation pIndustry oaramevervieterws … and proving resilient in times of economic uncertainty Global luxury goods Title for section H Global cosmetic goods market H X Welcome to the third edition of EY’s annual Sales of industry players are expected to grow at a healthy rate, led by double-digit annual growth rate for Financial Factbook for the luxury and cosmetics L’Occitane and Natura from FY11A to FY14E. X sector. Lhe >actbooc combines financial Increased demand through innovative products will cater to underserved emerging markets. data, insight from EY’s global team of sector X Introduction of eco-friendly, sustainable and naturally derived beauty products and cosmetics will stimulate specialists and opinions of external experts. demand in established geographies. ) Feo eajcels 3 Gnline plal^gjes _ainin_ pgpmlajily Titles for charts • New markets, such as India, South Africa and Turkey, generated more than two–thirds of the • Beauty, today, is synonymous with personalized products and services that enrich the beauty market growth in 2015. consumer experience and its relationship with brands in all distribution sectors. • 9sia%Hacific continued its lead as the world’s biggest cosmetics market and posted 4.3% • Online beauty sales registered 20% growth in 2015 on a worldwide basis and accounted for growth due to an acceleration in Southeast Asian markets, which has helped to offset the 6% of the beauty market. slight slowdown in economic growth rate in China. • Social media has made the online platform a critical part of every brand’s strategy. • The industry players are investing more resources in currently underrepresented countries • Luxury cosmetics remains the most dynamic sector with 5.7% growth in 2015, thanks in to spread their global reach and tap growth opportunities. particular to e–commerce sales. • The operators are increasinglq inclmding prodmcts in their portfolios to specificallq target consumers with lower disposable incomes. 2 ?jgoin_ eacemp cale_gjy 4 Targeting millennial consumers Titles for charts • Makeup is the most vibrant category for the third consecutive year and acted as a growth • There lies a strong opportunity for growth from millennial consumers, as their purchasing engine driven by the ËËselfie generation.’’ power is expected to reach US$3.4t by 2018 in the US alone. • The success of lip makeup is one of the 2015 highlights, with growth at 10% in the mass • Further, it is estimated that 75% of the US workforce will comprise millennials by 2020, market channel, and 16% in the selective channel. making it an attractive group for industry players. • It is a Öomrishing marcet as consmmers continme to explore neo loocs, and companies are • Eighty-six percent of millennials share their brand preferences online, which can help 1 offering new formulas and textures to cater to the rising demand. companies to reach wider consumer groups. • In addition, the push for natural cosmetics has opened new growth opportunities for smaller • A new shopping revolution is underway in how consumers shop at retail stores and online players in an otherwise highly competitive market. The trend has forced large companies to platforms, as new channels of communication, commerce and service converge due to the either acimire or denelop their oon ËËgreen’’ products. impact of millennial consumers. Source: Data based on consensus of several brokers’ reports for each company. SNooutersc:eMsa: Lrke’Ot créapail Atalinznatuioan il Rs bepaoserd ot 2n a o015n, Ee-smtoéne Lth aavuedreagr Ae ans onuf Dal Receempobert 2r 2001125 a. nd other selected research. NThoe 2tes0: 112 g) Eroswtéte Lh coaruredsepr Aondns tnuo tahl Re seapleos grt 2ro0w1th r5.ate between FY11A and FY12A/E. The luxury and cosmetics financial factbook 2016

Luxury and Cosmetic Financial Factbook Page 45 Page 47

Luxury and Cosmetic Financial Factbook Page 45 Page 47