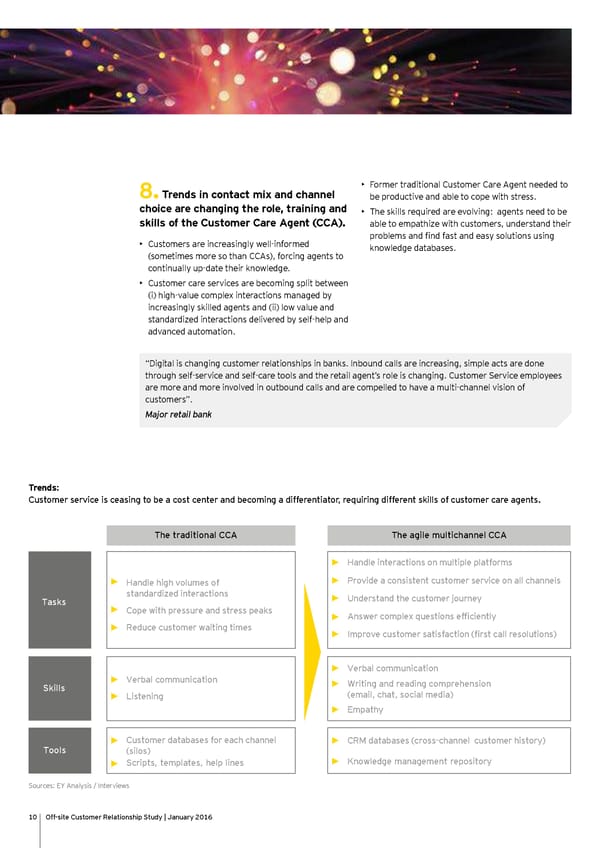

8. Trends in contact mix and ch annel • Former traditional Customer Care Agent needed to be productive and able to cope with stress. ch oice are ch anging th e role, training and • The skills required are evolving: agents need to be skills of th e C ustomer C are A gent ( C C A ) . able to empathize with customers, understand their • Customers are increasingly well-informed problems and find fast and easy solutions using (sometimes more so than CCAs), forcing agents to knowledge databases. continually up-date their knowledge. • Customer care services are becoming split between (i) high-value complex interactions managed by increasingly skilled agents and (ii) low value and standardized interactions delivered by self-help and advanced automation. “Digital is changing customer relationships in banks. Inbound calls are increasing, simple acts are done through self-service and self-care tools and the retail agent’s role is changing. Customer Service employees are more and more involved in outbound calls and are compelled to have a multi-channel vision of customers”. M aj or retail bank Trends: Customer service is ceasing to b e a cost center and b ecoming a differentiator, req uiring different skills of customer care agents. The tradit ional CCA The agile multichannel CCA ► H andle interactions on multiple platforms ► P rovide a consistent customer service on all channels ► H andle high volumes of standardiz ed interactions ► Tasks U nderstand the customer j ourney ► Cope w ith pressure and stress peaks ► 9nsoer complep iuestions efficiently ► R educe customer w aiting times ► Amprove customer satisfaction (first call resolutions) ► V erb al communication ► V erb al communication ► S kills W riting and reading comprehension ► L istening (email, chat, social media) ► Empathy ► Customer datab ases for each channel ► CJE dataZases (cross%channel customer history) Tools (silos) ► S cripts, templates, help lines ► K now ledge management repository Sources: EY Analysis / Interviews 10 O ff- site Customer R elationship S tudy | J anuary 2 016

Off-site Customer Relationship Study Page 9 Page 11

Off-site Customer Relationship Study Page 9 Page 11