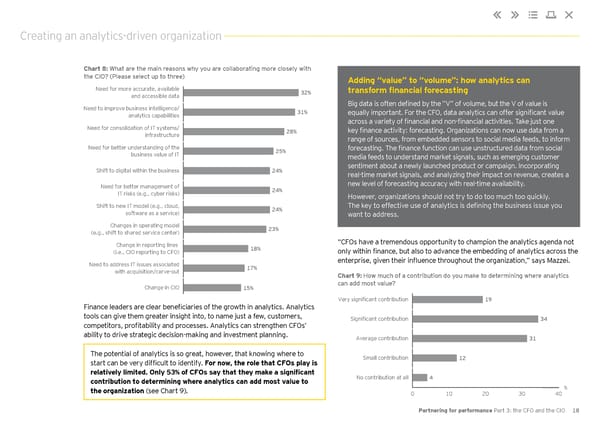

Creating an analytics-driven organization Chart 8: What are the main reasons why you are collaborating more closely with the CIO? (Please select up to three) Adding “value” to “volume”: how analytics can Need for more accurate, available 32% transform financial forecasting and accessible data Need to improve business intelligence/ Big data is often defined by the ”V” of volume, but the V of value is analytics capabilities 31% equally important. For the CFO, data analytics can offer significant value across a variety of financial and non-financial activities. Take just one lidation of IT systems/ Need for conso 28% key finance activity: forecasting. Organizations can now use data from a infrastructure range of sources, from embedded sensors to social media feeds, to inform Need for better understanding of the 25% forecasting. The finance function can use unstructured data from social business value of IT media feeds to understand market signals, such as emerging customer Shift to digital within the business 24% sentiment about a newly launched product or campaign. Incorporating real-time market signals, and analyzing their impact on revenue, creates a Need for better management of new level of forecasting accuracy with real-time availability. IT risks (e.g., cyber risks) 24% However, organizations should not try to do too much too quickly. Shift to new IT model (e.g., cloud, 24% The key to effective use of analytics is defining the business issue you software as a service) want to address. Changes in operating model 23% (e.g., shift to shared service center) Change in reporting lines “CFOs have a tremendous opportunity to champion the analytics agenda not (i.e., CIO reporting to CFO) 18% only within finance, but also to advance the embedding of analytics across the Need to address IT issues associated enterprise, given their influence throughout the organization,” says Mazzei. with acquisition/carve-out 17% Chart 9: How much of a contribution do you make to determining where analytics Change in CIO 15% can add most value? Very significant contribution 19 Finance leaders are clear beneficiaries of the growth in analytics. Analytics tools can give them greater insight into, to name just a few, customers, Significant contribution 34 competitors, profitability and processes. Analytics can strengthen CFOs’ ability to drive strategic decision-making and investment planning. Average contribution 31 The potential of analytics is so great, however, that knowing where to Small contribution 12 start can be very difficult to identify. For now, the role that CFOs play is relatively limited. Only 53% of CFOs say that they make a significant No contribution at all 4 contribution to determining where analytics can add most value to the organization (see Chart 9). % 0 10 20 30 40 Partnering for performance Part 3: the CFO and the CIO 18

Partnering for Performance Part 3 Page 17 Page 19

Partnering for Performance Part 3 Page 17 Page 19