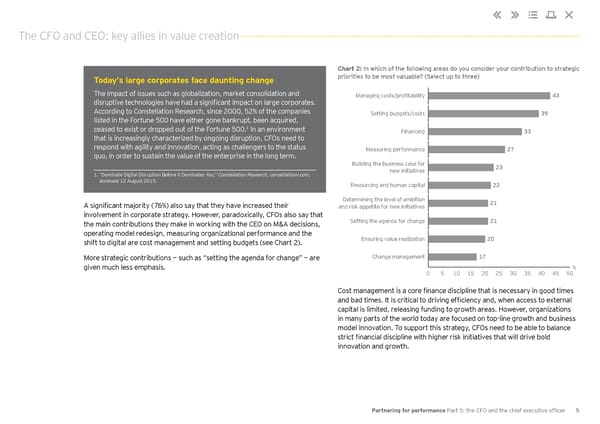

The CFO and CEO: key allies in value creation Chart 2: In which of the following areas do you consider your contribution to strategic Today’s large corporates face daunting change priorities to be most valuable? (Select up to three) The impact of issues such as globalization, market consolidation and Managing costs/profitability 43 disruptive technologies have had a significant impact on large corporates. According to Constellation Research, since 2000, 52% of the companies Setting budgets/costs 39 listed in the Fortune 500 have either gone bankrupt, been acquired, 1 ceased to exist or dropped out of the Fortune 500. In an environment Financing 33 that is increasingly characterized by ongoing disruption, CFOs need to respond with agility and innovation, acting as challengers to the status Measuring performance 27 quo, in order to sustain the value of the enterprise in the long term. Building the business case for 23 1. “Dominate Digital Disruption Before It Dominates You,” Constellation Research, consetllationr.com, new initiatives accessed 12 August 2015. Resourcing and human capital 22 A significant majority (76%) also say that they have increased their Determining the level of ambition 21 and risk appetite for new initiatives involvement in corporate strategy. However, paradoxically, CFOs also say that the main contributions they make in working with the CEO on M&A decisions, Setting the agenda for change 21 operating model redesign, measuring organizational performance and the Ensuring value realization 20 shift to digital are cost management and setting budgets (see Chart 2). More strategic contributions — such as “setting the agenda for change” — are Change management 17 given much less emphasis. % 0 5 10 15 20 25 30 35 40 45 50 Cost management is a core finance discipline that is necessary in good times and bad times. It is critical to driving efficiency and, when access to external capital is limited, releasing funding to growth areas. However, organizations in many parts of the world today are focused on top-line growth and business model innovation. To support this strategy, CFOs need to be able to balance strict financial discipline with higher risk initiatives that will drive bold innovation and growth. Partnering for performance Part 5: the CFO and the chief executive officer 5

Partnering for Performance Part 5 Page 6 Page 8

Partnering for Performance Part 5 Page 6 Page 8