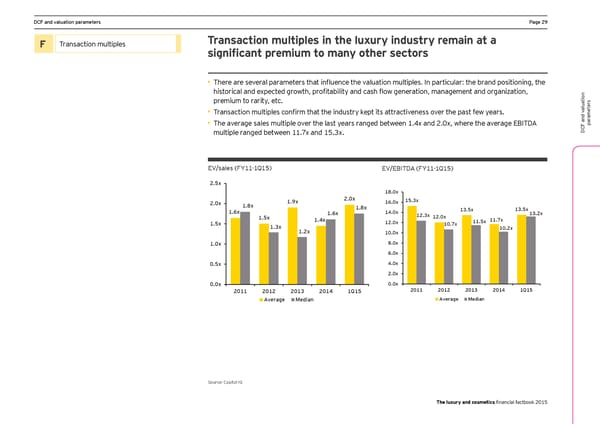

DCF and valuation parameters Page 29 F Transaction multiples Transaction multiples in the luxury industry remain at a significant premium to many other sectors • There are several parameters that influence the valuation multiples. In particular: the brand positioning, the historical and expected growth, profitability and cash flow generation, management and organization, premium to rarity, etc. s er • Transaction multiples confirm that the industry kept its attractiveness over the past few years. aluationt ame ar • The average sales multiple over the last years ranged between 1.4x and 2.0x, where the average EBITDA p multiple ranged between 11.7x and 15.3x. DCF and v EV/sales (FY11-1Q15) EV/EBITDA (FY11-1Q15) 2.5x 18.0x 2.0x 1.9x 2.0x 16.0x 15.3x 1.8x 1.8x 13.5x 13.5x 1.6x 1.6x 14.0x 12.3x 13.2x 1.5x 1.4x 12.0x 11.5x 11.7x 1.5x 1.3x 12.0x 10.7x 1.2x 10.0x 10.2x 1.0x 8.0x 6.0x 0.5x 4.0x 2.0x 0.0x 0.0x 2011 2012 2013 2014 1Q15 2011 2012 2013 2014 1Q15 Average Median Average Median Source: Capital IQ The luxury and cosmetics financial factbook 2015

Seeking sustainable growth - The luxury and cosmetics financial factbook Page 30 Page 32

Seeking sustainable growth - The luxury and cosmetics financial factbook Page 30 Page 32