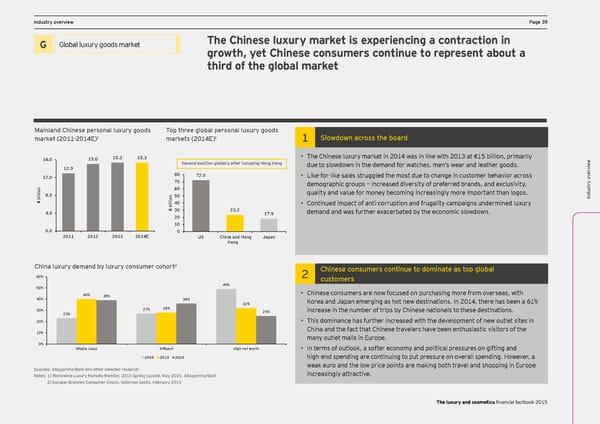

DCF and vIndustry oaluation pverview arameters PPage 39age 39 Ex ec The Chinese luxury market is experiencing a contraction in utiv Global luxury goods Title for section H Global luxury goods market e summary G growth, yet Chinese consumers continue to represent about a third of the global market X Welcome to the third edition of EY’s annual Sales of industry players are expected to grow at a healthy rate, led by double-digit annual growth rate for Financial Factbook for the luxury and cosmetics L’Occitane and Natura from FY11A to FY14E. DCF and v p X ar Increased demand through innovative products will cater to underserved emerging markets. sector. The Factbook combines financial ame data, insight from EY’s global team of sector X aluation Introduction of eco-friendly, sustainable and naturally derived beauty products and cosmetics will stimulate t er specialists and opinions of external experts. s demand in established geographies. Mainland Chinese personal luxury goods Top three global personal luxury goods 1 1 Slowdown across the board market (2011-2014E) markets (2014E) 1 Titles for charts 15.3 15.3 • The Chinese luxury market in 2014 was in line with 2013 at €15 billion, primarily 16.0 15.0 Second position globally after including Hong Kong due to slowdown in the demand for watches, men’s wear and leather goods. Indusw 12.9 80 try oervie 12.0 72.0 • Like-for-like sales struggled the most due to change in customer behavior across v 70 v n 60 demographic groups — increased diversity of preferred brands, and exclusivity, ervietry o o i l quality and value for money becoming increasingly more important than logos. l 8.0 w i n 50 Indus b o i € l l 40 i • Continued impact of anti-corruption and frugality campaigns undermined luxury b 4.0 € 30 23.2 demand and was further exacerbated by the economic slowdown. 20 17.9 10 0.0 0 and disMe 2011 2012 2013 2014E US China and Hong Japan thodology Kong claimer China luxury demand by luxury consumer cohort2 Chinese consumers continue to dominate as top global Titles for charts 60% 2 customers 49% 50% 40% • Chinese consumers are now focused on purchasing more from overseas, with and specific analyS 40% 39% 36% 32% Korea and Japan emerging as hot new destinations. In 2014, there has been a 61% ample s 30% 27% 28% 25% increase in the number of trips by Chinese nationals to these destinations. 23% election 20% • This dominance has further increased with the development of new outlet sites in s China and the fact that Chinese travelers have been enthusiastic visitors of the e 10% s many outlet malls in Europe. 0% Middle class Affluent High net worth • In terms of outlook, a softer economy and political pressures on gifting and 2004 2014 2024 high-end spending are continuing to put pressure on overall spending. However, a Source: Data based on consensus of several brokers’ reports for each C Glo company. weak euro and the low price points are making both travel and shopping in Europe on Sources: Altagamma/Bain and other selected research t s increasingly attractive. act uss NNootteess: 1:M) Warkoert cldawpidite Lalizuaxtuiory Mn is barakseetd os Mn a oonitonre, 2-m0o1n5 Sth aprvienrg Uage apdas otef D, Meacy 2em0b1e5r 2, A0lt1a2g.a mma/Bain ary The 2021) E2 gurroowpteh c: Borarrnedsepd Condos tnso tumhee sr Gaoleos gds, Growotldh rmaatn Se baecthwse, Fen FebrYu1a1rA ay 2n0d F15Y12A/E. The luxury and cosmetics financial factbook 2015

Seeking sustainable growth - The luxury and cosmetics financial factbook Page 40 Page 42

Seeking sustainable growth - The luxury and cosmetics financial factbook Page 40 Page 42