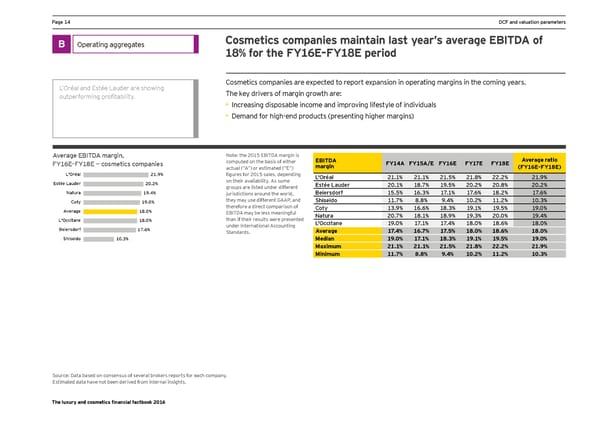

Ha_e ), DCF and valuation parameters Cosmetics companies maintain last year’s average EBITDA of B Operating aggregates Jimmy Choo 8.5% Prada 8.3% 18% for the FY16E–FY18E period Coach 7.2% Hugo Boss 6.7% Swatch 6.7% Cosmetics companies are expected to report expansion in operating margins in the coming years. L’Oréal and Estée Lauder are showing Tumi 6.5% The key drivers of margin growth are: omtperforming profitabilitq. YOOX Net-A-Porter 6.4% Hermès 6.3% • Increasing disposable income and improving lifestyle of individuals Burberry 6.3% • Demand for high-end products (presenting higher margins) Michael Kors 6.3% Richemont 5.8% Tiffany 5.6% Average 5.6% Salvatore Ferragamo 5.5% Average EBITDA margin, Note: the 2015 EBITDA margin is EBITDA Average ratio computed on the basis of either >Q).=Ç>Q)0= È cgseelics cgepanies Luxottica 5.5% FY14A FY15A/E FY16E FY17E FY18E actual (“A“) or estimated (“E“) margin (FY16E–FY18E) L'Oréal 21.9% Brunello Cucinelli 5.5% figmres for *()- sales, depending L'Oréal *)&) *)&) *)&- *)&0 **&* *)&1 Tod's 5.3% Estée Lauder 20.2% on their availability. As some Estée Lauder *(&) )0&/ )1&- *(&* *(&0 *(&* groups are listed under different Natura 19.4% LVMH 5.1% jurisdictions around the world, :eiejsdgj^ )-&- ).&+ )/&) )/&. )0&* )/&. Moncler 5.0% Coty 19.0% they may use different GAAP, and Shiseido ))&/ 0&0 1&, )(&* ))&* )(&+ Kering 4.9% therefore a direct comparison of Coty )+&1 ).&. )0&+ )1&) )1&- )1&( Average 18.0% EBITDA may be less meaningful Ralph Lauren 4.7% than if their results were presented Natura *(&/ )0&) )0&1 )1&+ *(&( )1&, L'Occitane 18.0% Kafilg 3.3% under International Accounting L'Occitane )1&( )/&) )/&, )0&( )0&. )0&( Beiersdorf 17.6% Chow Tai Fook 2.0% Average 17.4% 16.7% 17.5% 18.0% 18.6% 18.0% Standards. Shiseido 10.3% Hengdeli 0.8% Median 19.0% 17.1% 18.3% 19.1% 19.5% 19.0% Maximum 21.1% 21.1% 21.5% 21.8% 22.2% 21.9% Minimum 11.7% 8.8% 9.4% 10.2% 11.2% 10.3% Source: Data based on consensus of several brokers reports for each company. Estimated data have not been derived from internal insights. The luxury and cosmetics financial factbook 2016

Luxury and Cosmetic Financial Factbook Page 15 Page 17

Luxury and Cosmetic Financial Factbook Page 15 Page 17