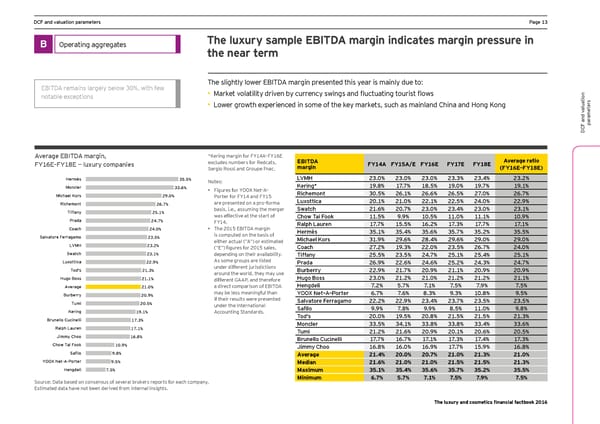

DCF and valuation parameters Ha_e )+ B Operating aggregates The luxury sample EBITDA margin indicates margin pressure in the near term EBITDA remains largely below 30%, with few The slightly lower EBITDA margin presented this year is mainly due to: • Earcet nolatilitq drinen bq cmrrencq soings and Ömctmating tomrist Öoos notable exceptions s • Lower growth experienced in some of the key markets, such as mainland China and Hong Kong er aluationt ame ar p DCF and v Average EBITDA margin, *Kering margin for FY14A–FY16E EBITDA Average ratio >Q).=Ç>Q)0= È lmpmjy cgepanies excludes numbers for Redcats, margin FY14A FY15A/E FY16E FY17E FY18E (FY16E–FY18E) Sergio Rossi and Groupe Fnac. Hermès 35.5% Notes: LVMH *+&( *+&( *+&( *+&+ *+&, *+&* Moncler 33.6% • Figures for YOOX Net–A– Kering* )1&0 )/&/ )0&- )1&( )1&/ )1&) Michael Kors 29.0% Porter for FY14 and FY15 Richemont +(&- *.&) *.&. *.&- */&( *.&/ Richemont 26.7% are presented on a pro–forma Luxottica *(&) *)&( **&) **&- *,&( **&1 Tiffany 25.1% basis, i.e., assuming the merger Swatch *)&. *(&/ *+&( *+&, *+&( *+&) was effective at the start of ;`go Lai >ggc ))&- 1&1 )(&- ))&( ))&) )(&1 Prada 24.7% FY14. Ralph Lauren )/&/ )-&- ).&* )/&+ )/&/ )/&) Coach 24.0% • The 2015 EBITDA margin Hermès +-&) +-&, +-&. +-&/ +-&* +-&- Salvatore Ferragamo 23.5% is computed on the basis of Michael Kors +)&1 *1&. *0&, *1&. *1&( *1&( LVMH 23.2% either actual (“A“) or estimated ÉEÉ! figmres for *()- sales, Coach */&* )1&+ **&( *+&- *.&/ *,&( Swatch 23.1% depending on their availability. Li^^any *-&- *+&- *,&/ *-&) *-&, *-&) Luxottica 22.9% As some groups are listed Prada *.&1 **&. *,&. *-&* *,&+ *,&/ Tod's 21.3% under different jurisdictions :mjZejjy **&1 *)&/ *(&1 *)&) *(&1 *(&1 around the world, they may use Hugo Boss *+&( *)&* *)&( *)&* *)&* *)&) Hugo Boss 21.1% different GAAP, and therefore Average 21.0% a direct comparison of EBITDA Hengdeli /&* -&/ /&) /&- /&1 /&- Burberry 20.9% may be less meaningful than YOOX Net–A–Porter .&/ /&. 0&+ 1&+ )(&0 1&- Tumi if their results were presented Salvatore Ferragamo **&* **&1 *+&, *+&/ *+&- *+&- 20.5% under the International Kafilg 1&1 /&0 1&1 0&- ))&( 1&0 L'Occitane9.7% Kering 19.1% Accounting Standards. Natura9.3% Brunello Cucinelli 17.3% Tod's *(&( )1&- *(&0 *)&- *)&- *)&+ Shiseido6.4% Ralph Lauren Moncler ++&- +,&) ++&0 ++&0 ++&, ++&. 17.1% Tumi *)&* *)&. *(&1 *(&) *(&. *(&- Average5.9% Jimmy Choo 16.8% Brunello Cucinelli )/&/ ).&/ )/&) )/&+ )/&, )/&+ Estée Lauder5.5% Chow Tai Fook 10.9% Bieey ;`gg ).&0 ).&( ).&1 )/&/ )-&1 ).&0 L'Oréal4.2% Kafilg 9.8% Average 21.4% 20.0% 20.7% 21.0% 21.3% 21.0% Beiersdorf4.0% YOOX Net-A-Porter 9.5% Median 21.6% 21.0% 21.0% 21.5% 21.5% 21.3% Coty2.0% Hengdeli 7.5% Maximum 35.1% 35.4% 35.6% 35.7% 35.2% 35.5% Source: Data based on consensus of several brokers reports for each company. Minimum 6.7% 5.7% 7.1% 7.5% 7.9% 7.5% Estimated data have not been derived from internal insights. The luxury and cosmetics financial factbook 2016

Luxury and Cosmetic Financial Factbook Page 14 Page 16

Luxury and Cosmetic Financial Factbook Page 14 Page 16