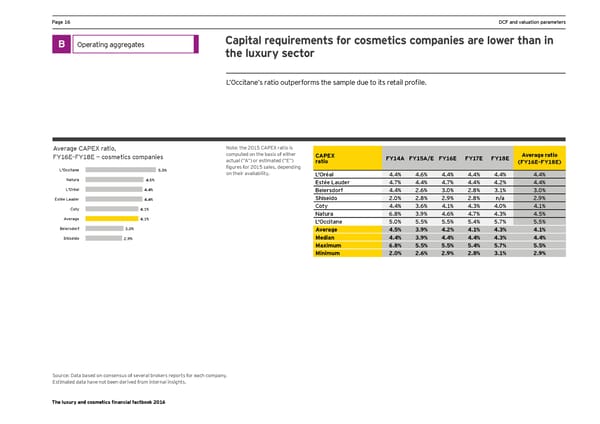

Ha_e ). DCF and valuation parameters B Operating aggregates Capital requirements for cosmetics companies are lower than in the luxury sector L’Occitane’s ratio omtperforms the sample dme to its retail profile. Average CAPEX ratio, Note: the 2015 CAPEX ratio is >Q).=Ç>Q)0= È cgseelics cgepanies computed on the basis of either CAPEX FY14A FY15A/E FY16E FY17E FY18E Average ratio actual (“A“) or estimated (“E“) ratio (FY16E–FY18E) L'Occitane 5.5% figmres for *()- sales, depending on their availability. L'Oréal ,&, ,&. ,&, ,&, ,&, ,&, Natura 4.5% Estée Lauder ,&/ ,&, ,&/ ,&, ,&* ,&, L'Oréal 4.4% :eiejsdgj^ ,&, *&. +&( *&0 +&) +&( Estée Lauder 4.4% Shiseido *&( *&0 *&1 *&0 n/a *&1 Coty 4.1% Coty ,&, +&. ,&) ,&+ ,&( ,&) Natura .&0 +&1 ,&. ,&/ ,&+ ,&- Average 4.1% L'Occitane -&( -&- -&- -&, -&/ -&- Beiersdorf 3.0% Average 4.5% 3.9% 4.2% 4.1% 4.3% 4.1% Shiseido 2.9% Median 4.4% 3.9% 4.4% 4.4% 4.3% 4.4% Maximum 6.8% 5.5% 5.5% 5.4% 5.7% 5.5% Minimum 2.0% 2.6% 2.9% 2.8% 3.1% 2.9% Source: Data based on consensus of several brokers reports for each company. Estimated data have not been derived from internal insights. The luxury and cosmetics financial factbook 2016

Luxury and Cosmetic Financial Factbook Page 17 Page 19

Luxury and Cosmetic Financial Factbook Page 17 Page 19