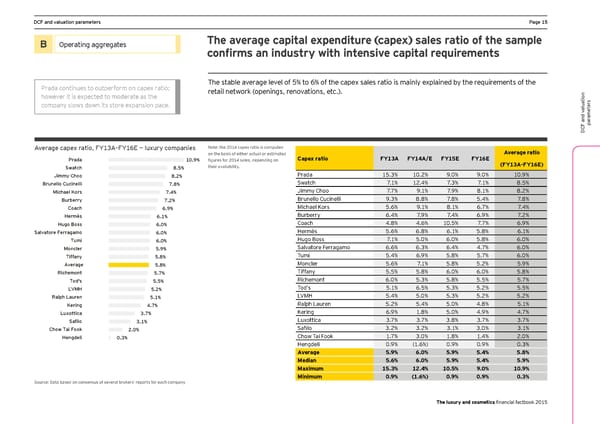

DCF and valuation parameters Page 15 B Operating aggregates The average capital expenditure (capex) sales ratio of the sample confirms an industry with intensive capital requirements Prada continues to outperform on capex ratio; The stable average level of 5% to 6% of the capex sales ratio is mainly explained by the requirements of the retail network (openings, renovations, etc.). however it is expected to moderate as the s company slows down its store expansion pace. er aluationt ame ar p DCF and v Average capex ratio, FY13A–FY16E — luxury companies Note: the 2014 capex ratio is computed Average ratio on the basis of either actual or estimated Capex ratio FY13A FY14A/E FY15E FY16E Prada 10.9% figures for 2014 sales, depending on (FY13A-FY16E) Swatch 8.5% their availability. Jimmy Choo 8.2% Prada 15.3% 10.2% 9.0% 9.0% 10.9% Brunello Cucinelli 7.8% Swatch 7.1% 12.4% 7.3% 7.1% 8.5% Michael Kors 7.4% Jimmy Choo 7.7% 9.1% 7.9% 8.1% 8.2% Burberry 7.2% Brunello Cucinelli 9.3% 8.8% 7.8% 5.4% 7.8% Coach 6.9% Michael Kors 5.6% 9.1% 8.1% 6.7% 7.4% Hermès 6.1% Burberry 6.4% 7.9% 7.4% 6.9% 7.2% Hugo Boss 6.0% Coach 4.8% 4.6% 10.5% 7.7% 6.9% Salvatore Ferragamo 6.0% Hermès 5.6% 6.8% 6.1% 5.8% 6.1% Tumi 6.0% Hugo Boss 7.1% 5.0% 6.0% 5.8% 6.0% Moncler 5.9% Salvatore Ferragamo 6.6% 6.3% 6.4% 4.7% 6.0% Tiffany 5.8% Tumi 5.4% 6.9% 5.8% 5.7% 6.0% Average 5.8% Moncler 5.6% 7.1% 5.8% 5.2% 5.9% Richemont 5.7% Tiffany 5.5% 5.8% 6.0% 6.0% 5.8% Tod's 5.5% Richemont 6.0% 5.3% 5.8% 5.5% 5.7% LVMH 5.2% Tod’s 5.1% 6.5% 5.3% 5.2% 5.5% Ralph Lauren 5.1% LVMH 5.4% 5.0% 5.3% 5.2% 5.2% Kering 4.7% Ralph Lauren 5.2% 5.4% 5.0% 4.8% 5.1% Luxottica 3.7% Kering 6.9% 1.8% 5.0% 4.9% 4.7% Safilo 3.1% Luxottica 3.7% 3.7% 3.8% 3.7% 3.7% Chow Tai Fook 2.0% Safilo 3.2% 3.2% 3.1% 3.0% 3.1% Hengdeli 0.3% Chow Tai Fook 1.7% 3.0% 1.8% 1.4% 2.0% Hengdeli 0.9% (1.6%) 0.9% 0.9% 0.3% Average 5.9% 6.0% 5.9% 5.4% 5.8% Median 5.6% 6.0% 5.9% 5.4% 5.9% Maximum 15.3% 12.4% 10.5% 9.0% 10.9% Minimum 0.9% (1.6%) 0.9% 0.9% 0.3% Source: Data based on consensus of several brokers’ reports for each company The luxury and cosmetics financial factbook 2015

Seeking sustainable growth - The luxury and cosmetics financial factbook Page 16 Page 18

Seeking sustainable growth - The luxury and cosmetics financial factbook Page 16 Page 18