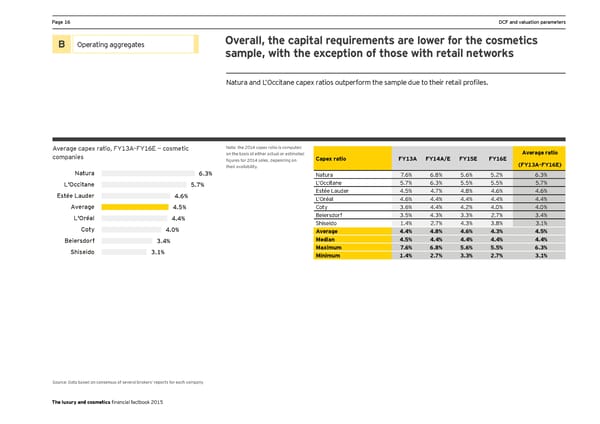

Page 16 DCF and valuation parameters B Operating aggregates Overall, the capital requirements are lower for the cosmetics sample, with the exception of those with retail networks Natura and L’Occitane capex ratios outperform the sample due to their retail profiles. Average capex ratio, FY13A–FY16E — cosmetic Note: the 2014 capex ratio is computed Average ratio companies on the basis of either actual or estimated Capex ratio FY13A FY14A/E FY15E FY16E figures for 2014 sales, depending on (FY13A-FY16E) their availability. Natura 6.3% Natura 7.6% 6.8% 5.6% 5.2% 6.3% L'Occitane 5.7% L’Occitane 5.7% 6.3% 5.5% 5.5% 5.7% Estée Lauder 4.6% Estée Lauder 4.5% 4.7% 4.8% 4.6% 4.6% L’Oréal 4.6% 4.4% 4.4% 4.4% 4.4% Average 4.5% Coty 3.6% 4.4% 4.2% 4.0% 4.0% L'Oréal 4.4% Beiersdorf 3.5% 4.3% 3.3% 2.7% 3.4% Shiseido 1.4% 2.7% 4.3% 3.8% 3.1% Coty 4.0% Average 4.4% 4.8% 4.6% 4.3% 4.5% Beiersdorf 3.4% Median 4.5% 4.4% 4.4% 4.4% 4.4% Shiseido 3.1% Maximum 7.6% 6.8% 5.6% 5.5% 6.3% Minimum 1.4% 2.7% 3.3% 2.7% 3.1% Source: Data based on consensus of several brokers’ reports for each company The luxury and cosmetics financial factbook 2015

Seeking sustainable growth - The luxury and cosmetics financial factbook Page 17 Page 19

Seeking sustainable growth - The luxury and cosmetics financial factbook Page 17 Page 19