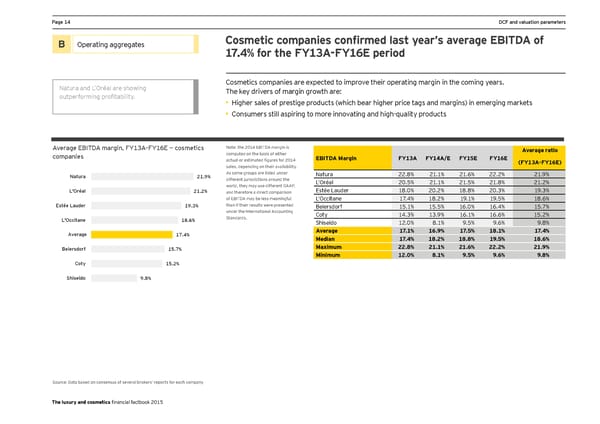

Page 14 DCF and valuation parameters B Operating aggregates Cosmetic companies confirmed last year’s average EBITDA of 17.4% for the FY13A-FY16E period Natura and L’Oréal are showing Cosmetics companies are expected to improve their operating margin in the coming years. outperforming profitability. The key drivers of margin growth are: • Higher sales of prestige products (which bear higher price tags and margins) in emerging markets • Consumers still aspiring to more innovating and high-quality products Average EBITDA margin, FY13A–FY16E — cosmetics Note: the 2014 EBITDA margin is Average ratio companies computed on the basis of either EBITDA Margin FY13A FY14A/E FY15E FY16E actual or estimated figures for 2014 (FY13A-FY16E) sales, depending on their availability. Natura 21.9% As some groups are listed under Natura 22.8% 21.1% 21.6% 22.2% 21.9% different jurisdictions around the L’Oréal 20.5% 21.1% 21.5% 21.8% 21.2% world, they may use different GAAP, Estée Lauder 18.0% 20.2% 18.8% 20.3% 19.3% L'Oréal 21.2% and therefore a direct comparison of EBITDA may be less meaningful L’Occitane 17.4% 18.2% 19.1% 19.5% 18.6% Estée Lauder 19.3% than if their results were presented Beiersdorf 15.1% 15.5% 16.0% 16.4% 15.7% under the International Accounting Coty 14.3% 13.9% 16.1% 16.6% 15.2% L'Occitane 18.6% Standards. Shiseido 12.0% 8.1% 9.5% 9.6% 9.8% Average 17.4% Average 17.1% 16.9% 17.5% 18.1% 17.4% Median 17.4% 18.2% 18.8% 19.5% 18.6% Beiersdorf 15.7% Maximum 22.8% 21.1% 21.6% 22.2% 21.9% Minimum 12.0% 8.1% 9.5% 9.6% 9.8% Coty 15.2% Shiseido 9.8% Source: Data based on consensus of several brokers’ reports for each company The luxury and cosmetics financial factbook 2015

Seeking sustainable growth - The luxury and cosmetics financial factbook Page 15 Page 17

Seeking sustainable growth - The luxury and cosmetics financial factbook Page 15 Page 17