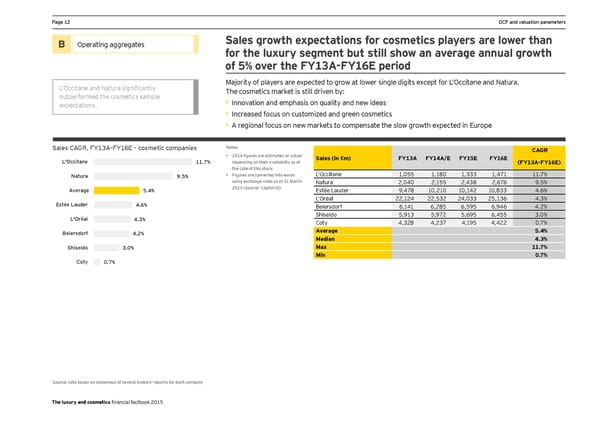

Page 12 DCF and valuation parameters B Operating aggregates Sales growth expectations for cosmetics players are lower than for the luxury segment but still show an average annual growth of 5% over the FY13A-FY16E period L’Occitane and Natura significantly Majority of players are expected to grow at lower single digits except for L’Occitane and Natura. outperformed the cosmetics sample The cosmetics market is still driven by: expectations. • Innovation and emphasis on quality and new ideas • Increased focus on customized and green cosmetics • A regional focus on new markets to compensate the slow growth expected in Europe Sales CAGR, FY13A–FY16E – cosmetic companies Notes: CAGR • 2014 figures are estimated or actual Sales (in €m) FY13A FY14A/E FY15E FY16E L'Occitane 11.7% depending on their availability as of (FY13A-FY16E) the date of this study. Natura 9.5% • Figures are converted into euros L’Occitane 1,055 1,180 1,333 1,471 11.7% using exchange rates as of 31 March Natura 2,040 2,155 2,438 2,676 9.5% Average 5.4% 2015 (Source: Capital IQ). Estée Lauder 9,478 10,210 10,142 10,833 4.6% L’Oréal 22,124 22,532 24,033 25,136 4.3% Estée Lauder 4.6% Beiersdorf 6,141 6,285 6,595 6,946 4.2% L'Oréal 4.3% Shiseido 5,913 5,972 5,695 6,455 3.0% Coty 4,328 4,237 4,195 4,422 0.7% Beiersdorf 4.2% Average 5.4% Median 4.3% Shiseido 3.0% Max 11.7% Min 0.7% Coty 0.7% Source: data based on consensus of several brokers’ reports for each company The luxury and cosmetics financial factbook 2015

Seeking sustainable growth - The luxury and cosmetics financial factbook Page 13 Page 15

Seeking sustainable growth - The luxury and cosmetics financial factbook Page 13 Page 15